Company Special: Alcoa charts growth plan in line with China

|

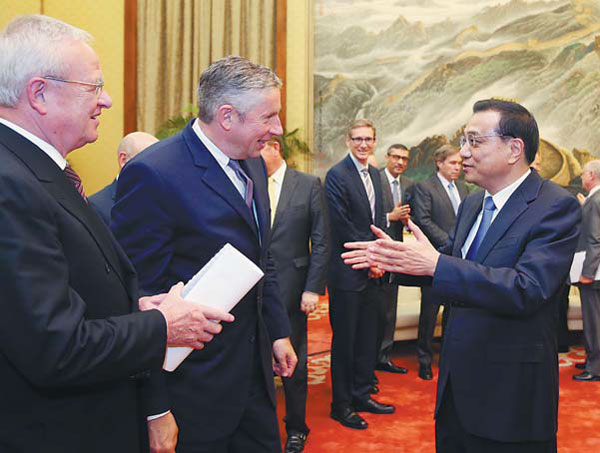

Premier Li Keqiang meets a group of international business leaders in Beijing on June 9, including Klaus Kleinfeld (center), chairman and CEO of US aluminum producer Alcoa. Xinhua |

Q+A: Klaus Kleinfeld

Before the Summer Davos held in Dalian, Liaoning province, from Wednesday to Friday, Klaus Kleinfeld, chairman and CEO of Alcoa, the lightweight metals leader, shared his insights into his company's growth with China Daily reporter Lyv Chang.

This year's Summer Davos revolves around the theme of "charting a new course for growth". How is Alcoa charting its route for growth and transformation?

Our transformation goals are twofold. The first is to build Alcoa's value-added businesses that serve high-growth, high-margin markets. With our recent acquisitions and organic investments, we have broadened our capabilities to become a lightweight multimaterial powerhouse to support that objective. The second is about making our commodity businesses, including bauxite, alumina and aluminum, more competitive by moving further down the alumina and aluminum cost curves. These are the two key engines driving value.

In 2014, we delivered Alcoa's strongest full-year operating results since 2008, with revenue of $23.9 billion in 2014 providing a solid footing for the company this year.

We are focusing our value-added businesses on multiple growth markets, including in the aerospace and automotive sectors.

In the aerospace sector, we acquired jet-engine component maker Firth Rixson and aerospace structural parts maker TITAL to expand our capabilities and meet the growing demand for more efficient jet engines and increase our multimaterials portfolio.

Firth Rixson alone doubled Alcoa's average revenue content on key new-generation jet engine programs. Today, we can build more than 90 percent of all the structural and rotating components of a jet engine.

We also just acquired RTI International Metals, a global supplier of titanium and specialty metals products and services for the commercial aerospace, defense, oil and gas, and medical device markets.

On the organic investment side, we have developed a number of new innovations.

At the end of last year, we introduced the revolutionary Alcoa Micromill technology, which enables production of an automotive alloy that is twice as formable and 30 percent lighter than high-strength steel. Alcoa micromill technology reduces the time to transform molten metal into aluminum coil from 20 days to 20 minutes. This innovation is a breakthrough technology in the automotive industry. It will change the way cars look in the future.

Following a $90 million investment at our Lafayette, Indiana, plant, we built the world's largest aluminumlithium facility and now have the world's most complete aluminum-lithium portfolio. This advanced alloy has allowed us to develop the aerospace industry's first aluminumlithium fan blade for Pratt and Whitney's revolutionary PurePower jet engine that uses its geared turbofan technology that recently qualified for Airbus' new A320 NEO. Alcoa's aluminum-lithium also lowers the weight of single-aisle fuselage applications by up to 10 percent versus composites, while meeting more stringent engine performance requirements.

Our downstream strategy is proving to be successful. Alcoa's innovation and close customer partnerships form the basis of our ability to create new, more efficient industry solutions.

How does this transformation affect China?

With the recent Firth Rixson and TITAL acquisitions, and the newly acquired RTI, Alcoa is increasing its presence in China. However, our transformation is based on much more than acquisitions. From a value-added perspective, we now have a much broader product offering in China.

Today, we have facilities targeting value-added businesses from fasteners, to commercial wheels and automotive heat exchangers, to aerospace applications and titanium castings. By doing so, we position the company to take advantage of growth opportunities in this dynamic nation. I am continuously optimistic about its growth. Our materials meet Chinese demand for high-grade aluminum, titanium and steel used in the aerospace and automotive industries and some industrial applications. These areas are where we are strongest in China.

Equally important is our upstream business where we have positioned ourselves to be a globally competitive commodity business, including in bauxite and alumina. These are promising areas for us given that China imports about 60 percent of the global bauxite supply, and we have had strong bauxite interest from Chinese companies.

Ford's new F-150 pickup truck got a lot of attention for having an aluminum body. Alcoa played a critical role in its launch. Is that the beginning of a trend? How do you see the prospects of aluminumintensive vehicles in China?

The F-150 is the best-selling vehicle in the US and has been for the past 35 years. By replacing steel with an aluminumintensive body, Ford reduced the weight of the F-150 by more than 700 pounds (317.5 kilograms). Consumers now have better fuel efficiency or can carry 700 pounds of additional payload without having to sacrifice performance or safety.

Ford sells about 730,000 vehicles of the F-150 model per year. This is an important shift. To put things into perspective, the Audi A8, the first aluminum-intensive car, which was launched back in the early 1990s, has since sold 780,000 units to date.

The trend to aluminumintensive vehicles is here to stay. As other auto manufacturers pick up on the trend and transition to aluminum, we forecast stronger growth and have made additional investments in our manufacturing plants to enable us to capture that growth.

Making autos lighter in weight is a strong global trend. When I met with Premier Li Keqiang at the third round table summit of the Global CEO Council in June, he emphasized China's desire to transition toward a more sustainable, greener economy. In the years ahead, I believe, China will see more demand for lightweight and electric vehicles, buses and trucks. We at Alcoa are perfectly positioned to support this.

The collaboration between Alcoa and BYD is a perfect example. We worked together to develop an all-aluminum space frame and bus design for BYD that reduced the weight of the BYD electric bus body by 40 percent - nearly one metric ton versus steel options - providing superior range. As China addresses air pollution and as the domestic Chinese automotive, bus and truck sectors consider new regulatory stances, partnerships like this one offer viable solutions.

The Chinese government proposed the "Made in China 2025" action plan earlier this year. Has Alcoa made any specific arrangements or plans in response to it?

China's future growth model and economic development will be driven by innovation. Policymakers in China have already taken important steps toward realizing an innovation-driven economy; nowhere is this further evident than in the "Made in China 2025" plan that emphasizes value-added production and intelligent manufacturing.

"Made in China 2025" sets a 10-year plan for China to comprehensively upgrade its industrial sector and sets critical targets for innovation, green manufacturing and smart manufacturing. For example, by 2025, the plan calls for the R&D expense of manufacturing enterprises to double, 40 manufacturing innovation centers to be established and carbon dioxide emissions to be reduced by 40 percent from 2015 levels across all industries. Additionally the plan identifies ten sectors to be targeted for growth, including aerospace, marine, rail, energy-saving vehicles, and new materials.

Our growing footprint in China, through our recent acquisitions and investment in new facilities, is aligned with the "Made in China 2025" action plan. All of our facilities based in China are dedicated to producing innovative and high value-added products needed to power productive sectors of the economy like aerospace, automotive and commercial transportation.

In terms of importance for China, there are also joint venture opportunities in the upstream sector. We have always been open to cooperate more with Chinese State-owned enterprises and continue our dialogue with them..

What suggestions or experiences would you share with Chinese companies, especially in the manufacturing industry, if they want to reach the targets set by the "Made in China 2025" strategy?

At Alcoa, we have curtailed over 30 percent of our high-cost smelting capacity. While this has involved difficult choices, it has been undertaken as part of our larger strategy of creating a globally competitive commodity business and growing our value-added businesses.

China's leadership has made a particular commitment to addressing such structural challenges as overcapacity in the country's manufacturing base by focusing on industrywide upgrading. In the aluminum sector, we know that even as China replaces high-cost capacity with new state-of-the-art smelters in the country's western provinces, there are companies that operate unprofitable aluminum smelters, partly because of the excess capacity. This in turn ends up harming the global aluminum industry. These types of activities are also detrimental to an efficient use of the country's critical resources and risk China's ability to achieve ambitious environmental targets.

Contact the writer at lvchang@chinadaily.com.cn

(China Daily 09/09/2015 page21)