Company champions its remote service as the 'future of banking'

Since launching the Virtual Teller Machine remote bank solution in 2011, Huawei Technologies Co Ltd has been improving the product, making it available on a range of mobile devices.

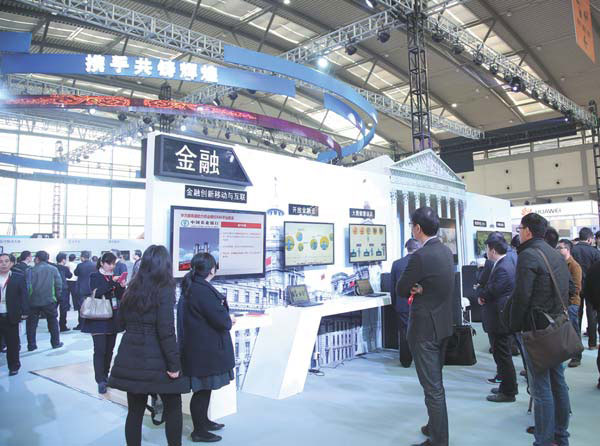

The most updated solution package, showcased at the 2015 Huawei Chinese Partners Conference in March in Xi'an of Shaanxi province, allows people to access bank services from almost anywhere.

According to the company, VTM allows customers to speak to a bank representative via video and is "the future of the banking industry". With self-service expanding from ATMs to computers to mobile phones, technology has made retail financial transactions personalized. VTM combines self-service with personal interaction from a teller at a distant location. The remote teller completes transactions and answers any questions the user might have.

After Huawei tapped into the Philippines with its VTM remote bank solution, David Zhang, Huawei director for enterprise product solutions sales, told the local news network InterAksyon that VTMs could replace bank branches, reduce transaction costs, increase revenue and improve customer satisfaction and user-experience. Currently, banks in China, South Africa, Russia, the United States and Europe use the technology, which costs about $100,000.

"VTMs are about 24/7 round-the-clock service with high security. It's an entirely different experience for clients - virtual and professional. Deployment is easy and can be installed in many high traffic spots like shopping malls, a business campus, airports and hotels," Zhang said.

In the past few years, Huawei and its partners have explored and developed the VTM field.

During the Huawei Chinese Partners Conference, the latest VTM solution was presented in a 4,000-square-meter exhibition zone named "Smart Financing". It displayed mobile smart terminals, interface devices and supporting software and systems for the VTM solution. Visitors also saw the process of opening a bank account at home using the remote bank service system.

During the display, a bank account manager brought a mobile terminal device and an interface device to the customer's home. The customer put his ID card on the interface device and talked to a teller through a video call. The teller checked the customers' identity and received his ID information. The most crucial part of opening an account was finished, simple and quick, all from the comfort of the customer's home.

According to the company, with the ID checking service, financing institutions can offer a range of non-cash businesses and bring them to customers.

Huawei's VTM remote bank solution is used in several banks in China, including Bank of China and Bank of Lanzhou.

zhuanti@chinadaily.com.cn

|

The "Smart Finance" exhibition during the 2015 Huawei Chinese Partners Conference presents the company's latest virtual teller machine solution. Photos Provided to China Daily |

|

At the 2015 Huawei Chinese Partners Conference in March, forums and lectures cover hot topics like the integration of communications technologies into financial institutions. |

(China Daily 06/30/2015 page3)