German auto parts maker expands in China

ZF prepares for a long-term presence in world's largest car market, Tang Zhihao reports.

ZF Friedrichshafen AG, a German automotive chassis and driveline technology company, will continue to expand in the Chinese market while the nation adapts to its "new normal" economic conditions.

The company is developing fast in China to increase its footprint and production capacity, according to Stefan Sommer, chief executive officer of ZF.

|

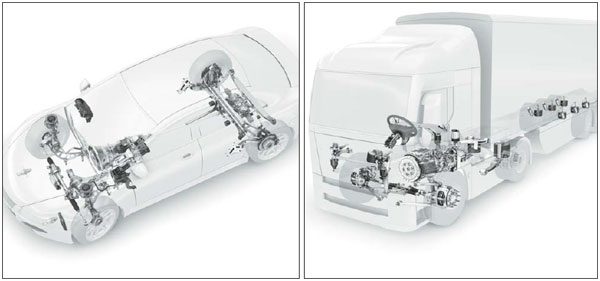

The company focuses on developing lightweight and electrification components for car markets. Photos provided to China Daily |

|

ZF aims to further extend its research and development and reinforce its market presence in the Far East. |

|

ZF offers a complete product range for driveline, chassis and electronics to the automotive industry. The portfolio will be enlarged with safety products and sensor technology by the aquisition of TRW. |

The company is building factories close to international automakers to respond to client demand more efficiently.

ZF also plans to increase investment in product innovation and increase its purchase capacity to enhance the company's performance in China.

"If you look at the GDP growth rate you see these kind of new normal economic conditions in China, but if you consider the total volume of the Chinese auto market, it is the biggest market in the world. At absolute level, it is a significant high growth rate," said Sommer. "We are preparing for a long-term presence in China."

China overtook the United States in 2009 to become the world's largest automotive market. Government authorities estimated that China would have more than 200 million vehicles by 2020, which will create strong demand in the auto parts market.

ZF China reported higher than industrial average growth in 2014, which accounted for 15 percent of ZF's global sales. The company maintained double digit growth in the past few years in China.

"Our business was very positive in 2014, we ended up with more than 20 billion yuan ($3.2 billion) in sales and that was strong growth compared to 2013. Our expectations for this year are also positive," Sommer said.

The evolving demand of Chinese consumers creates ample opportunities for auto parts makers, but also means fierce competition. In the past three decades, almost all world leading automotive parts makers have opened branches in China.

ZF has operated in China for more than three decades and is sparing no effort to maintain its competitiveness and its beat rivals.

"On one side, we are improving our technologies to have a unique technology-driven product portfolio to serve customers. On the other side, we need to be more production efficient to be a cost leader," said Sommer.

He said the company is working hard to provide superior technologies at the lowest cost. It is focusing on developing lightweight and electrification components.

China is one of ZF's regional headquarters and has more than 700 engineers focused on development in its engineering center.

ZF invests more than 5 percent of its sales in research and development each year.

In July 2014, ZF China announced plans to expand its headquarters in Shanghai to further extend R&D and to reinforce its market presence in the Far East.

According to ZF, the space for offices, laboratories and test benches will more than quadruple from 11,000 square meters to 54,000 sq m.

The project is due to be completed by the end of 2015 and will primarily be home to laboratories and test benches.

"Here, we will then be able to test products of car driveline and chassis technology as well as commercial vehicle or construction machinery transmissions," said Sommer.

He said it would be the first time that engineers from all divisions of the group would be united under one roof, which would make it easier for engineers to establish networks and exchange knowledge to adapt products specifically for the Asian market.

ZF's leading customers in China include automotive giants such as BMW, Audi, Mercdes Benz, Ford and Volkswagen.

To support growth in the Chinese market, ZF also established strong relationships with locally developed auto brands such as SAIC, Great Wall, BAIC and FAW.

ZF said about 30 percent of its sales in China were due to local automakers, who are willing to improve the quality of their vehicles to trade both domestically and globally.

As Chinese authorities promote new-energy cars and lower energy consumption and pollution, ZF is working closely with local partners to develop pure electric cars.

The acquisition of US TRW Automotive is expected to help ZF strengthen its competitiveness in the market. The $12.4 billion acquisition was announced in September last year and will make ZF the third-largest auto parts maker in the world.

Sommer said ZF identified three mega trends in the auto market, which are fuel-efficient vehicles, autonomous driving systems and driving safety system development.

"Our existing businesses will well serve the first trend but there are two additional trends which we are not strong enough to serve with our technology and production," said Sommer.

"We would like to participate in the remaining two mega trends. We identified TRW as an ideal company well positioned in the market and very successful in technologies in autonomous diving systems and safety systems," he added.

Sommer believes the acquisition will bring more benefits to the Chinese market and better serve local consumer demand.

"We will have more products to offer to Chinese customers. We have more supply bases. This gives us opportunities to further grow our businesses in the local market," said Sommer.

With the acquisition of TRW, ZF could more than double its sales in China, he added.

In the next three to five years, there will be no mergers and acquisitions in such a significant volume similar to the TRW case, however, in small areas these will still be possible, according to Sommer.

"In the next three to five years, we will concentrate on the integration of TRW," he said. TRW will be completely merged into ZF upon the completion of acquisition, according to Sommer.

ZF is one of the top 10 automotive suppliers in the world and has operated in China since the 1980s. By 2014 it had 113 production companies in 26 countries.

ZF expanded at an enormous speed in China during the past 20 years. Since 1994, the company has set up 20 production locations in cities including Beijing, Shanghai, Changchun, Chongqing, Hangzhou, Zhuhai, Liuzhou and Shenyang.

The company celebrates its 100th anniversary in 2015 and is very positive about the Chinese market with long-term China investments planned.

"We are seeing increasing costs but China has many competitive advantages.

"We want to be in the market and for the market so we can react in short times and meet expectations of consumers.

"It will also help to save transportation costs and import costs," said Sommer.

To mark the 100th anniversary, ZF announced that all its 113 production bases worldwide would be involved in anniversary activities during the year, strengthening the common understanding for the long term.

Contact the writer at tangzhihao@chinadaily.com.cn

(China Daily 04/22/2015 page12)