New forms of collateral let farmers access credit

Gao Yonghua, an aquaculture farmer in Ningbo, Zhejiang province, obtained a 300,000 yuan ($49,230) loan from a local credit union a few days ago to expand his fish ponds.

This is the fourth consecutive year the Jiangbei district resident has benefited from a financial policy specifically designed for rural residents, who tend to have had fewer assets for collateral relative to their urban peers. Under China's current land regulations, farmers only have rights to use land but cannot directly sell or mortgage it.

To ease financing pressures on farmers, the district government cooperated with the credit union to expand collateral coverage for loans in rural areas.

The financial innovation they initiated in 2009, the first of its kind in the country, enables farmers to get credit by using as collateral their contractual rights to arable land management, as well as homes and equity in economic cooperatives.

"The new type of credit is responsive and offers a very favorable interest rate, thus soon putting me on the path of wealth," Gao said.

With an infusion of capital, he has been able to expand his aquaculture farms to more than 2.67 hectares, and his products now enjoy a high reputation among consumers in supermarkets across the city.

Gao is among nearly 2,500 beneficiaries of the financial innovation in the district. They have received loans totaling 301 million yuan as of the end of this September.

Following Jiangbei district's suit, other parts of the coastal city in East China have also begun testing the water in rural financial reform.

In Ninghai county, the Caiti Fruit and Vegetable Cooperative secured a 2.5 million yuan loan after collateralizing a 56.5-hectare hill as well as orange trees on it in 2011.

This is the first forestry resource-collateralized loan in the province, marking the first time that land and forestry resources have been used as collateral for loans in the county, local media reports.

In Xiangshan county, financiers have also included fishing boats and the rights to use sea areas in the collateral coverage to meet the needs of farmer startups, modern agricultural development and new countryside construction. Government data shows that in the first nine months of this year alone, the innovative loans surpassed 1.25 billion yuan in the county, benefiting nearly 20,000 families in its rural areas.

The rapid acceptance of the rural financial reform is in part attributed to the Ningbo branch of the People's Bank of China.

Since the launch of the new type of credit, it has released a series of policies to promote the practice across the entire city. Their emphasis is to put on leading farmers, farmer cooperatives and runners of family farms.

"Financial institutions in the city will continue a three-year financial plan that supports innovation-driven development and promotes the favorable rural financial policies," said an official at the local bank.

"Our goal is to reduce the financial resource divide and expand access of the swift and modern financial services to more rural residents," he said.

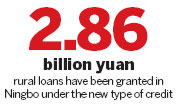

Under the new type of credit, local financiers in the city have granted rural loans totaling some 2.86 billion yuan, which satisfies financing demands in agricultural production and inspires tens of thousands of farmers' interest in startup projects, local government officials said.

zhuanti@chinadaily.com.cn

(China Daily 11/21/2013 page12)