A shares tipped to 'rebound'

|

The benchmark Shanghai Composite Index rose by 0.12 percent to 2385.42 on Thursday. An Xin / For China Daily |

But analysts remain skeptical over optimistic stock market outlook

Despite a stock market rally in China, which boosted share prices almost across the board, there is still some way to go in revaluation that could take prices to even higher levels in 2013, a leading research firm said.

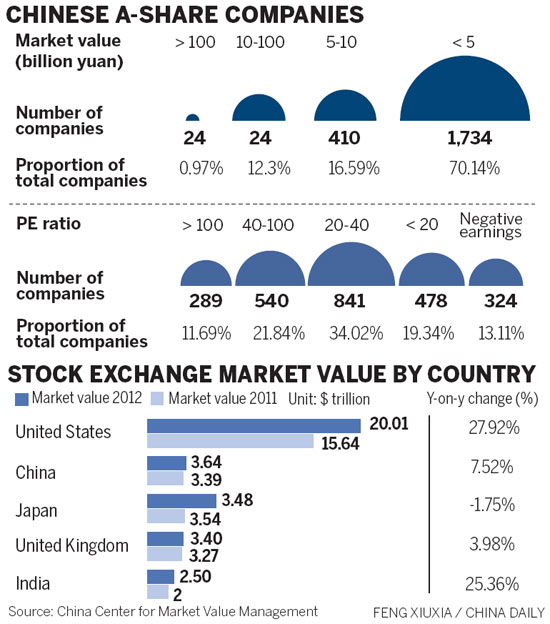

China Center for Market Value Management said in a report that revaluation of A shares will "rebound to a more reasonable level" from those seen currently.

But some analysts remain skeptical about such optimism. They said they have not seen clear signs that major publicly listed enterprises have succeeded in lowering their operating margins to improve efficiency and profitability.

The research firm's report said market value fell to 19.81 trillion yuan ($3.19 trillion) in late November, after it reached 24.27 trillion yuan at the end of 2009, making it the second-highest in the world.

But with investors' confidence boosted by prospects of an economic recovery, and with the new leadership's determination to push forward reform, the stock market started to rebound in December.

The report said: "The A-share market will stabilize and rebound in 2013, with valuation levels returning to a reasonable range. Total market value will rise as blue chips rally from undervaluation." It did not give a specific growth expectation.

The benchmark Shanghai Composite Index rose by 0.12 percent to 2385.42 on Thursday, led by a strong performance in sectors including nonferrous metals, coal, environmental protection, insurance, banking and securities. It has gained for four consecutive days.

It has risen about 22 percent from a four-year low in early December, outperforming Japan's booming Nikkei index in the same period.

Combined turnover on China's two bourses in Shanghai and Shenzhen shrank, totaling 212.5 billion yuan, down from 229.9 billion yuan on Wednesday.

However, some analysts and investors are still too shell-shocked from the prolonged slump in the past two years to jump onto the bandwagon. Their reluctance is reflected in a jittery market performance in the past few weeks despite increased turnover.

Dariusz Kowalczyk, senior economist and strategist with Credit Agricole, said: "At this point, after the recent gains, we no longer think that Chinese equities are that cheap."

While they remain attractive based on price-earnings ratios, operating margin is relatively high, which increases the risk of a correction, and "our measure of the macroeconomic environment is not favorable either", he said.

Li Jian, an analyst with Everbright Securities, said: "Overall, I see some more upside, but it is limited. I suggest taking a cautious attitude. The Shanghai index is very likely to climb to the 2400 level before the Chinese New Year, but you cannot ignore risks, especially after some enterprises announce annual reports."

Although recent economic indices have been encouraging and indicate a recovery, corporate performance, requiring a large injection of capital, has remained in doubt.

CNBC quoted Peter Elston, head of Asia Pacific Strategy and Asset Allocation at Aberdeen Asset Management, as saying on Wednesday: "Yes, at the moment you are seeing a spurt in the Chinese stock market, but we think the best way to invest in China is through high-quality companies, Hong Kong companies that do business in China, where as an investor you know you are going to be looked after."

An examination by the China Securities Journal early last month of the projected earnings released by China's 1,045 A-share listed companies showed that 960 firms said their combined net profits are likely to range between 145.74 billion yuan - representing a 13.78 percent decline year-on-year - and 174.53 billion yuan, indicating only a slight rebound of 3.24 percent.

The market value management report said private companies are showing a stronger vitality than State-owned enterprises, as their valuation and market value both grow faster than the latter's.

A report by HSBC on Wednesday said stock investment is promising in 2013, especially in emerging markets - particularly China - where valuation is relatively low if calculated by price to net asset value ratio.

xieyu@chinadaily.com.cn

(China Daily 02/01/2013 page15)