China's M&A deals tipped to rebound in 2013

Domestic and foreign-inbound mergers and acquisitions deals by strategic investors fell to a five-year low last year, but activity will rebound in 2013, international accounting firm PricewaterhouseCoopers said.

Last year, 2,953 M&A deals were made by domestic and foreign strategic buyers in China and their value totaled $97.1 billion, down 28 percent year-on-year, according to a report released by PwC on Wednesday.

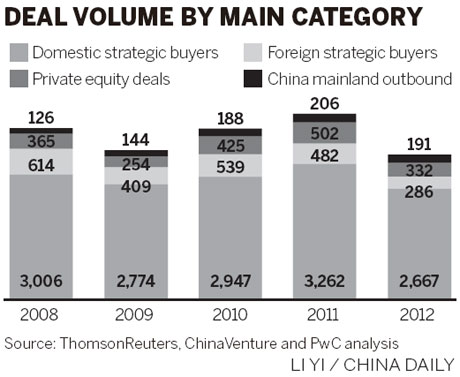

Overall, there were 4,115 M&A deals related to the Chinese market totaling $199.5 billion, down 9 percent year-on-year.

In addition to strategic M&A deals, the value of deals by financial buyers - private equity and venture capital firms - also declined, but only outbound deals showed growth.

"Global economic uncertainty and the soft landing of the Chinese economy may be the main reasons behind the five-year low," Leon Qian, PwC Northern China transaction services leader, told China Daily.

Qian added that domestic and foreign-inbound strategic M&A activity was even worse than the activity seen after the global financial crisis because the Chinese government launched a 4 trillion yuan ($605 billion) stimulus package in November 2008.

"As the direction of the Chinese economy becomes clearer, industry consolidation accelerates, domestic leadership changes take effect, and foreign economies start to emerge from their stressed positions, this should result in a strong rebound in China domestic and foreign-inbound strategic deals in 2013," said Qian.

According to the report, Japan remained the most active foreign-inbound M&A investor in China in 2012 for the second consecutive year, but the number of deals involving Japanese investors declined 30 percent year-on-year, mainly because of the Diaoyu Islands issue. The biggest deals in 2012 still came from the United States and Europe.

Although the number of the Chinese mainland's outbound deals surprisingly showed a small decline to 191 in 2012 from 206 in 2011, deal values grew 54 percent year-on-year to reach a new record high of $65.2 billion, comprising more than a third of overall M&A activity measured by value, by far the highest proportion ever, the report said.

"We see many more deals in the pipeline and expect this growth trend to continue strongly with another record year in 2013," said Edwin Wong, PwC China outbound investment leader.

The report also said private companies took on larger deals and will be the key drivers in the future growth of China outbound M&A activity.

"The growing activity of private-sector buyers in acquiring industrial technologies and consumer-linked businesses overseas is an important trend. Many of these deals are aimed at bringing advanced western technologies, know-how, intellectual property and brands back for use in the Chinese domestic market," Wong said.

The report added that private equity and venture capital firms have emerged as key providers of capital to the liquidity-starved private sector in China.

New deals and exit activity will accelerate strongly from the second quarter of 2013 as pricing expectations adjust, 2012 results become available, initial public offering markets reopen and China's leadership transition takes effect, the report said.

Private equity deal activity - which comprises new investments and exits by both IPOs and M&A - will reach new record highs in 2013 or 2014, it added.

caixiao@chinadaily.com.cn

(China Daily 01/31/2013 page14)