Investors rush to buy shares in green companies

The anticipated government action to clean up the air quality in cities, including Beijing and Shanghai, has triggered a rush for shares in companies that specialize in pollution-control equipment and technology.

Chen Fangming, a Shanghai-based private equity fund manager, said shares in the environmental protection sub-index of China's A-share market have risen more than 8 percent in the past two weeks, as investors anticipate government investment in the green sector to be "very large indeed."

In recent days, he said investors have been targeting companies across the environmental sector, particularly vendors of products that can help reduce air pollution and hazardous emissions, and enhance air quality.

He declined to reveal exact details, but said he expects returns from the investments to be strong over the next few years.

"Bad air quality and hazardous smog, if not kept under control, will endanger economic development, and investors are realizing it is essential to nip pollution in the bud," Chen said.

Shanghai-listed Zhejiang Feida Environmental Science and Technology Co Ltd, a company that designs and manufactures air quality control equipment, led the rally in the environmental protection sub-index on Wednesday, closing at 15.08 yuan per share, up by the daily top limit of 10 percent.

"Environmental protection is not a short-term opportunity. Innovation in this industry represents a long-term prospect for investors," added Chen.

The renewed interest from Chen and other investors is likely to reverse the fortunes of a sector that largely fell out of favor in 2012, during an economic slowdown when the need for growth overshadowed concerns for the environment.

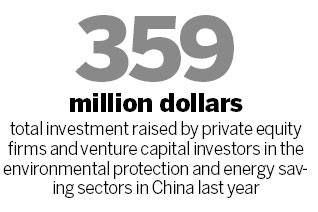

A report released last week by ChinaVenture Investment Consulting Group said only 27 deals were made by private equity firms and venture capital investors in the environmental protection and energy saving sectors in China last year, a 43.8 percent year-on-year fall.

Total investment was worth $359 million, a 52.2 percent year-on-year drop and the lowest level since 2009, when investment reached $1.04 billion.

As many as 12 of those 27 deals involved pollution monitoring and abatement companies, raising $189 million, and just two companies in the industry had initial public offerings approved, raising a total of $264 million, the report said.

The clean energy sector also reported sharp falls in investment in 2012, with just eight deals raising $510 million, an 82.8 percent year-on-year drop in number, and a 48.9 percent year-on-year drop in value.

Both the number of deals and funds raised were the lowest since 2008.

Li Ling, an analyst with ChinaVenture, said private investor interest in the clean energy industry dropped last year to what he called "freezing point", due to shrinking profit margins, excessive production capacity, and difficult export environment.

Yin Hao, a Shanghai-based venture capital professional, added: "Investing in environmental protection industries and sectors requires a comprehensive understanding of pollution issues, and I believe there is little point in making short-term, speculative investments, as the industry still needs more time to mature."

Yin added that improving air quality will require considerably more effort than purifying and cleaning up water.

"You can direct the water to treatment centers, but you can't put a huge filter in the air above a city," Yin said.

He predicted that companies selling products and services that reduce emissions, such as enhancing the quality of fuels and gases, could be in particularly huge demand in future.

wuyiyao@chinadaily.com.cn

(China Daily 01/24/2013 page14)