China to be main buyer of Iraqi oil by 2030, says IEA

China will become the main customer for Iraqi oil by the 2030s, with the Middle Eastern country overtaking Russia to become the world's second-largest oil exporter by then, the International Energy Agency said on Monday.

China will also continue to invest substantially in Iraqi oil production infrastructure, the agency said in its annual world energy report.

But one expert reminded Chinese companies to prepare for possible political risks in Iraq even though that country has become more stable since the Iraq war.

The agency's chief economist, Fatih Birol, said: "Iraq will emerge as a major new oil producer by the 2030s. Its main customer will be China, and half of Iraqi oil production will go to China."

The agency is a Paris-based autonomous intergovernmental organization set up in 1974 in the wake of the 1973 oil crisis, and Birol is responsible for its annual World Energy Outlook, recognized as the most authoritative source for strategic analysis of global energy markets.

The agency predicts that oil output in Iraq will exceed 6 million barrels per day (mb/d) in 2020 and rise to more than 8 mb/d by 2035.

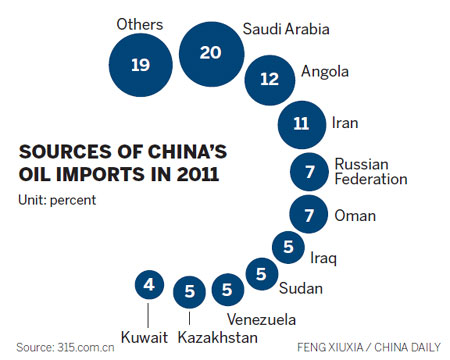

Iraq only accounted for 5 percent of China's oil imports last year, or about 275,000 barrels per day, and currently produces about 3.3-3.5 mb/d.

In its report, the agency predicts the United States will become the world's largest oil producer, overtaking Saudi Arabia, by around 2020. It says this will lead to a continued fall in oil imports by the US, which is likely to become a net oil exporter by about 2030.

"This accelerates the switch in direction of international oil trade toward Asia, putting a focus on the security of the strategic routes that bring Middle East oil to Asian markets," the agency said.

Growth in oil consumption by emerging economies, particularly for transport in China, India and the Middle East, will push global oil consumption steadily higher by 2035.

The world's oil demand will reach 99.7 mb/d and the average IEA crude oil import price will rise to $125 per barrel (in year 2011 dollar terms) by 2035, the report says.

Lin Boqiang, director of the China Center for Energy Economic Research at Xiamen University, said: "Increasing oil imports from Iraq is very possible and beneficial for China. Compared with other countries in the Middle East, Iraq is relatively stable at present, but we still should be aware of the risks."

He also said China should look to Canada for energy supply, but one analyst suggested Canada cannot make significant progress in a short time.

"Canada is rich in unconventional energy such as oil sands (a type of petroleum deposit)," said Li Li, senior analyst at ICIS C1 Energy, a Shanghai-based energy information consultancy. "But conservative forces in Canada are not very open to foreign investors in the energy field."

He uses the CNOOC-Nexen deal is an example.

Canada has twice delayed a judgment over whether to permit the $15.1 billion bid by CNOOC, China's leading offshore oil and gas producer, for Canadian oil company Nexen Inc, despite shareholders giving it their backing.

Li said the Middle East will continue to be an important crude oil supplier for China. Africa, South America and the Caspian Sea will also play more important roles in China's crude imports, she said.

More than 10 percent of China's crude imports are from South America, with an annual growth rate of 20 percent, according to C1 Energy.

Birol said China will be a major driver of global production and consumption of natural gas as Beijing increases its efforts at diversifying its energy mix to achieve more sustainable growth.

The IEA predicts that active policy support and regulatory reforms will push China's consumption of natural gas from around 130 billion cubic meters (bcm) in 2011 to 545 bcm in 2035.

Birol said: "I expect China's shale gas production will increase significantly. Also, China will be the leader in the world in terms of the use of renewable energy."

These changes will have implications for the price of energy in different countries, as China's electricity prices in 2035 will be three times cheaper than those in Europe and four times cheaper than in Japan, he said.

Birol also said China faces three major challenges: improving energy efficiency as much as possible, increasing shale gas production to reduce the use of coal and imported gas, and pushing forward low-carbon technologies, such as nuclear power and renewable energy.

Contact the writers at lixiang@chinadaily.com.cn and dujuan@chinadaily.com.cn

(China Daily 11/13/2012 page13)