Grape expectations from Argentina

|

Farmers harvesting grapes in a vineyard in Mendoza, Argentina. The country's wine makers, the world's fifth largest producer by volume, are eager to try their fortunes in the Chinese market, although it appears now there is no one capable enough of challenging the French wine makers' position in China's wine market. Provided to China Daily |

South American country foments a big wine export drive to China

A beginning should be as good as it is simple. That's what Antonio Mompo, manager for Wines of Argentina in Asia, the South American country's wine export organization, had in mind when he set out to promote Argentinian wine in China.

"Argentine wine has a simple and fresh taste, which is easy to drink and caters to the Chinese sweet palate," Mompo said. He believed this simple and pleasant mouthfeel can help the Chinese develop the habit of drinking wine.

Yet industry data seem to argue that the country has already become a confirmed wine drinker. A significant increase was seen in the country's wine supply over the past seven years: It surged from fewer than 400 million liters in 2004 to 1,400 million liters in 2011, according to a report by Rabobank.

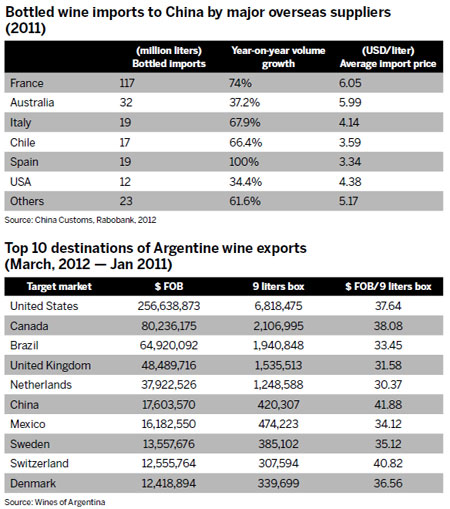

In 2011 alone, bottled wine imports into China jumped by 65 percent from the previous year to 241 million liters, the strongest growth since the global financial recession in 2007/8, according to the report. Strong growth, huge potential and the ability to devour a large amount of premium wine make China one of the most important export markets for wine suppliers across the world.

France, among the foreign suppliers, continued to dominate China's wine market in 2011, growing volumes to more than three-and-a-half times that of Australia, its nearest runner-up, according to the Rabobank report.

Although there seems to be no one capable of challenging France in the Chinese market in the near future, competition among lesser rivals is still fierce. Being one of the newcomers, Argentine wine makers, currently the world's fifth largest producer by volume, are eager to try their fortunes in this bewilderingly complicated market as well.

New World wine

Just like many things in the New World, wine was brought to Argentina by immigrants from Italy and Spain in the late 19th and early 20th century. But whereas many New World wine-making countries, including Chile, New Zealand and Australia, exported most of their wine, Argentine people drank most of theirs at home.

At a certain point in time, each person in Argentina imbibed the equivalent of 90 liters of wine every year. The amount is around 30 liters nowadays. "When I was young, there were three kinds of drinks in the house: water, water with wine and wine - and the amount of wine was determined by the age of the person," Laura Catena, an author, cited an Argentina winemaker, a 90-year-old descendant of a wine-making family, as saying in her book Vino Argentino (Argentine Wine). The high level of domestic consumption helps explain why the world remained unfamiliar with Argentinian wine until about three decades ago.

The turning point, brought about by a man named Nicolas Catena, Laura Catena's father, came in the early 1980s. An economist by training, Nicolas Catena, determined to challenge Europe's position, launched a revolution in the central area of western Argentina's Mendoza region, which now produces 70 percent of the nation's wine.

After studying viniculture, Nicolas Catena found in Mendoza the cool climate that was typical of the world's most famous wine regions by planting at higher elevations. Sheltered by the Andes Mountains from Pacific rains, the coolness and low precipitation allow vines to ripen slowly and retain acidity, allowing resultant wines to develop heightened aromas and complex flavors.

Malbec, the most famous wine grape varietal, is another key factor in Argentina's rise to becoming a major winemaker in the world. The Malbec grape, one of five Bordeaux varietals (the others are Merlot, Cabernet Sauvignon, Carberet Franc and Petit Verdot), used to be very popular with French wineries. Unfortunately, the emergence of phylloxera in the late 19th century, a disease caused by an aphid-like insect, wiped out the grape completely in its French homeland.

To the East

At the same time, brought over by immigrants from the Old World continent, the Malbec grape adapted successfully to Argentina's soil and sunny climate and was widely planted. Combining dark, ripe concentrated flavors with a rich and smooth texture, the Malbec grape soon became one of the fastest growing wine exports, winning world recognition for its second home.

Naturally, winemakers in Argentina expect Malbec to charm the Chinese just as it did in other markets. "Compared with European wines, Argentine wines have softer tannins and cleaner aromas, making it taste less aggressive," said the renowned Mariano Di Paola, head winemaker at Rutini Wines in Mendoza.

Despite not being one of the largest producers in volume among Argentine wineries, Rutini (owned by La Rural Vinedos y Bodegas SA) is currently the largest seller to China, with its sales far ahead of its nearest follower in recent years.

But the company's success in China not only relies on its wine's simple, inviting tastes but also on a number of marketing factors. "Rutini Wines is a well recognized brand among the Chinese circle in Argentina and was mainly sold to East China's Fujian province - where its members came from. The wine thrived based on that connection," said Antonio Mompo from Wines of Argentina.

In addition, the fact that the name "Rutini" is easy to pronounce and remember in the Chinese language helped the winery to establish its presence, enabling it to sell a lot of premium wines to the Chinese market, said Sol Asensio, Rutini Wines export manager for Asia and Latin America.

To consolidate its position in China, Rutini Wines intends to continue promoting its image as a high-end wine producer in Argentina. "We are trying to become the Chateau Lafite for Argentine wines," Asensio said.

Argentine winemakers are by no means shy of competing in quality with other foreign wine suppliers, including France. Unlike other countries, the climate in Argentina is very stable so the vineyards do not have distinctively good years or bad years, said Gonzalo Carrasco, winemaker at Terrazas de los Andes winery. Moreover, warm or cold years give different fruit profiles to the wines, he added.

"As a result, our wine's quality has been improving each year and it is easy for our customers to form a certain expectation before opening a bottle of Argentine wine," he said. "They seldom feel disappointed."

Terrazas de los Andes winery, owned by the French luxury group LVMH Moet Hennessy Louis Vuitton SA, exports 80 percent of its wine every year, its top three markets being the United States, the United Kingdom and Brazil. China is now indisputably the most important market, Carrasco said. "And we are confident of our own styles (in wine)."

Another advantage for Argentine wine is its reasonable price, which will help Argentine winemakers confirm their market position, many Chinese wine critics believe. "The Chinese will soon realize this is a good wine at a good price," said Tommy Lam, wine program director at Shanghai Jiaotong University.

'China, a continent'

Not all wineries in Argentina can draw on the connection among Chinese people like Rutini does to promote their images. One big challenge for the South American country's winemakers is to find a reliable partner and establish distribution channels in China's complicated market.

"We are constantly looking for new opportunities to develop the Trapiche brand in China," said Ramiro Eduardo Barrios, area export manager at the Trapiche winery. Owned by Argentina's largest wine producer Penaflor SA, Trapiche is the country's largest exported premium brand.

Barrios also expressed concerns about the popularity of premium Argentine wine in China's gift market. "The numbers are good but you just don't know whether this will help promote the brand," he said.

Another concern for the winemakers about China's market, Barrios added, is its slack regulation. This has led to numerous fake and counterfeited premium wines, causing quite a stir in the international winemaking industry. French wines suffered the most. The situation came to a head this year as Chateau Lafite was pressed to launch a campaign to fight fake products in the country.

"All in all, China is definitely a core market for Trapiche and we envision big growth rates over the next few years for Trapiche and Argentina as well," Barrios said.

A reliable and capable Chinese partner becomes all the more important against this background. Catena Zapata, the winery owned by Nicolas Catena's family, is a case in point. "We wasted a few years, but we finally found a good partner," said Jorge Crotta, export manager at the winery.

Catena Zapata is now in an exclusive partnership with a Chinese company Beijing BETC Group, which owns two high-end restaurants featuring Argentine food, one located in Beijing and the other in Shanghai.

Since the partnership was formed in 2011, sales of Catena Zapata's wine have increased steadily, Crotta said. "We are working closely in China to avoid infringements of our wine," he added.

People with experience in the industry, however, do not encourage winemakers to concentrate on China's big cities such as Beijing, Shanghai and Guangzhou. "Competition in first-tier cities such as Beijing and Shanghai is very fierce. There is only limited space for a newcomer such as Argentine wine," said Antonio Mompo from Wines of Argentina.

With nine years of industry experience in China's market, Mompo was convinced that the real business potential for the wine industry lies in China's emerging second- and third-tier cities, where increasing disposable income enabled the residents to try some affordable foreign wine.

"Rutini's success is very telling - just one province in China is enough to push up its sales," Mompo said. "China is a continent in terms of business strategies. It is very complicated and all its submarkets are very important," he added.

Submarkets, in the meantime, may also have lower thresholds. It does not require a big brand promotion to enter these markets, which means there are opportunities for small wineries. Krontiras is a small winery in Mendoza and this year it managed to send a container of premium wine to an importer in Northwest China's Shaanxi province.

"This is our first container to China. We hope this could lead to something and we are very optimistic," said Thanassis Vafiadis, manager at the winery.

Wine generation

Who are the wine drinkers in China today? According to the report by Rabobank, a large proportion of them are aged between 20 and 39 who earn more than 4,000 yuan ($630) a month in a skilled profession.

To most Chinese, wine has a positive connection with the Western lifestyle and is not yet considered as luxurious as whisky or brandy, or as ordinary as beer, according to the report. This would provide a wine supplier with a strong market position when competing with makers of other liquors, the report said.

"Grape wines are more likely to attract either younger, better educated, wealthier and/or female drinkers than baijiu (China's traditional spirit) or beer...with the potential to form a strong and dynamic consumer base in years to come," the report said.

In the meantime, the report also pointed out that the number of people drinking wine is still relatively small and limited in geographical scope. And it may still take some time before Chinese wine afficionados start exploring imported wines in big numbers.

"It will still take some time before the Chinese get familiar with the wine culture so, rather than being led by the brand, they could choose wine based on personal judgment and preference," agreed Mompo with Wines of Argentina.

Yet Mompo said he also noticed an emerging younger generation who have developed a genuine fondness for the wine culture and are catching up very fast. This younger generation has formed its own wine circles through the Internet where they can share information and knowledge, Mompo said.

So far this generation is still at a relatively early stage of its life and does not have enough purchasing power but, when the time comes, "China will change the world's wine industry," Mompo added.

zhousiyu@chinadaily.com.cn

|

Sheltered by the Andes Mountains and fed by its melt water, wineries in the Mendoza area - the winemaking area in the center of West Argentina that produces 70 percent of the beverage in the South American country - command a breathtaking view of leafy green vineyards growing against a background of snow-capped mountains. Photos Provided to China Daily |

|

A horse-riding gaucho between vineyards in Mendoza, the winemaking area in the center of West Argentina that produces the majority of wine products in the country. Strong growth, huge potential and the ability to devour a large amount of premium wine are making China one of the most important export markets for wine suppliers across the world. |

(China Daily 09/03/2012 page13)