What's news

|

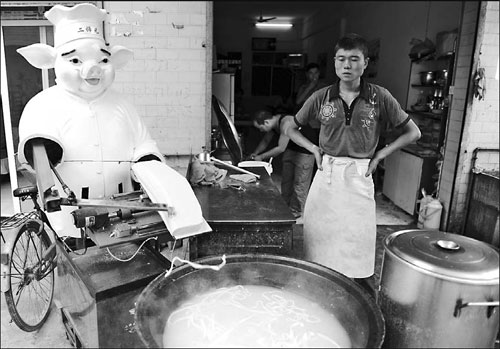

A "Zhu Bajie" robot chops noodles on Monday at a restaurant in Ducheng village in the suburb of Xi'an, Shaanxi province. Zhu Bajie, or Pig, is a character, known for his big appetite, from Journey to the West, a classic of Chinese literature. Zhang Yuan / China News Service |

Sinopharm profit rises on demand for medicine

Sinopharm Group Co, China's biggest pharmaceutical distributor, posted a 22 percent increase in first-half profits as broader health insurance coverage and higher subsidies spurred demand for medicine.

Net income rose to 959.1 million yuan ($151 million), or 40 yuan a share, in the six months ending June 30, from 784.5 million yuan, or 34 yuan, a year earlier, the Shanghai-based company said in a statement on Thursday. Sales jumped 39 percent, to 66.6 billion yuan.

Drug distributors including Sinopharm and Shanghai Pharmaceuticals Holding Co are benefiting from higher government spending on healthcare, which has expanded insurance coverage and boosted subsidies. As many as 95 percent of Chinese last year were covered by medical insurance, up from 87 percent in 2008, according to the Ministry of Health.

"The company should be on track to meet its targets this year," said Gideon Lo, an analyst with Nomura Holdings Inc in Hong Kong. "China's healthcare sector is also less affected by the economic slowdown as industry leaders such as Sinopharm gain from more government investments."

China Unicom's Q2 profit exceeds estimates

China Unicom (Hong Kong) Ltd, the nation's second-largest mobile-phone company, posted a second-quarter profit that surpassed analysts' estimates as smartphone users who download music and videos boosted sales.

Net income fell 2 percent to 2.42 billion yuan ($381 million), from a restated 2.47 billion yuan a year earlier, based on figures derived from half-year earnings the company reported on Thursday. That compares with the 2.1 billion-yuan median of five analysts' estimates in a Bloomberg News survey.

Chairman Chang Xiaobing has turned to cheaper smartphones from Chinese suppliers Lenovo Group Ltd, ZTE Corp and Huawei Technologies Co Ltd to trim subsidy costs and reduced reliance on Apple Inc's iPhone to lure new users. Unicom lost exclusive rights to offer the iPhone with a service plan in the nation when China Telecom Corp began selling the device on March 9.

"We believe the mass market and subsidy strategies of China Unicom in the 3G market have effectively enabled China Unicom to gain market share," Andy Poon, a Hong Kong-based analyst with Kim Eng Securities Ltd, wrote in a report on Tuesday.

Nation's demand for metals to gain in second half

Metals consumption in China, the world's biggest user, is expected to climb in the second half on easier availability of credit and rising investment and seasonal demand, according to China International Capital Corp.

Home appliance and vehicle sales, especially truck sales, should improve in the fourth quarter, while the weak property market may continue to face "headwinds," said analysts James Luke, Janet Kong and Liu Zheng, in a report on Wednesday. CICC is the nation's largest investment bank.

People's Bank of China Governor Zhou Xiaochuan said on Wednesday that adjustments to interest rates and banks' reserve requirements are still possible after the central bank stepped up temporary cash injections this month.

The Conference Board's Leading Economic Index for the world's second-largest economy rose in July after a little-changed June reading, signaling that the nation's economy may be stabilizing. Aluminum, zinc, and nickel producers in China have cut output in response to falling prices and higher costs.

Trinity growth to accelerate on economic policies

Trinity Ltd, the high-end menswear retailer that sells Gieves & Hawkes and Cerruti in China, expects sales to increase faster next year as the government takes steps to boost economic growth.

Growth may pick up next year after same-store sales increased about 6.5 percent in the first half, Managing Director Sunny Wong said in an interview on Thursday. He expects comparable-store sales growth to climb "mid-to-high single digits" for the full year.

Wong joins other executives who are forecasting better sales for the consumer industry in 2013 after a slowing economy curbed spending this year. Hengdeli Holdings Ltd, Swatch Group AG's China retail partner, this week said it expects luxury sales to improve next year. China has cut interest rates twice since June amid economic growth that has slowed for six straight quarters.

"I'm generally more optimistic about next year," Wong said. "If China's exports come back, and the government puts forward some monetary easing or stimulus measures, we'll have a greater chance for a better performance."

Wharf posts higher profit on Shanghai luxury project

Wharf (Holdings) Ltd, the Hong Kong builder expanding in at least 14 other Chinese cities, said first-half underlying profit rose 49 percent after booking sales from a Shanghai luxury-home project and as rental income climbed.

Profit excluding property revaluations, and one-time gains advanced to HK$5.43 billion ($699 million) in the six months ended June 30 from HK$3.64 billion a year earlier, Wharf said on Thursday in a filing to Hong Kong's stock exchange. That exceeds the HK$4 billion median estimate of three analysts surveyed by Bloomberg News.

Earnings were boosted by developments that include the Xi Yuan project in Shanghai, where sales began before the country's government stepped up real estate curbs to make housing more affordable. Wharf's Times Square and Harbour City shopping malls in Hong Kong posted gains as mainland tourists continued spending in the city even as the nation's economy slows.

Growth from the mainland is "a reflection of Wharf's expansion in its China properties in recent years," Stephen Wan and Mark Webb, analysts at HSBC Holdings Plc, wrote in report this week.

F&P Appliances forecasts earnings rebound

Fisher & Paykel Appliances Holdings Ltd, New Zealand's largest maker of refrigerators, forecasts operating earnings will rebound as much as 59 percent this year on new products and sales in China.

Earnings before interest and tax will be between NZ$70 million ($57 million) and NZ$78 million in the year ending March 31, compared with NZ$49.1 million a year earlier, the Auckland-based company said in a statement. Profit slumped 16 percent last year because of weak demand.

F&P is developing new washing machines, refrigerators and ovens, and is adapting its DishDrawer washer for the China market in association with 20 percent shareholder Haier Corp, CEO Stuart Broadhurst said in notes for a speech to shareholders on Thursday. The company is targeting as much as 4 percent-a-year revenue growth from its appliances unit by 2016.

The company hasn't paid a dividend since 2009, but intends to resume distributions this year, it said.

Shandong Heavy seeks stake in Germany's Kion

Shandong Heavy Industry Group Co Ltd, the Chinese construction machinery producer, is seeking a 25 percent stake in German fork-lift manufacturer Kion Group GmbH, according to a report in German newspaper Handelsblatt, citing sources with knowledge of the negotiations.

Wiesbaden-based Kion belonged to industry group Linde AG until 2006 and now is owned by finance houses Goldman Sachs Group Inc and KKR & Co LP.

With an expected price of around 700 million euro ($879m), the transaction would be the biggest investment yet by a Chinese company in Germany, Handelsblatt said.

Manufacturing industry may see faster deterioration

China's manufacturing industry may deteriorate faster in August due to a slump in new orders, which may prompt Beijing into more aggressive growth-stabilizing plans, according to an HSBC economic index.

Forecasts made in the manufacturing Purchasing Managers' Index fell sharply to 47.8 in August from July's 49.3 figure, hitting the lowest level in 9 months, HSBC said.

The indicator has now been lower than the equilibrium level of 50 for 10 consecutive months, meaning the country's manufacturing sector is contracting. Any reading above 50 shows expansion.

The HSBC report said that Chinese producers are still struggling with both strong global headwinds and weak domestic demand, as shown by the sub-index of output that declined to 47.9 from 50.9 in July, the lowest figure in five months.

Baidu in travel services deal with UK's Skyscanner

Baidu Inc, China's largest Web-search company, has agreed a deal with Skyscanner, the British flight search engine, for travel services and information covering the Chinese market, according to a Financial Times report.

The move comes two years after Baidu rival Google Inc bought flight-information software maker ITA Software, as Google ramps up its efforts in travel-related online searches.

Baidu will present Skyscanner's international flight results, which include more than 750 million airfares from about 900 airlines, when users search for such information.

Last year, Baidu bought a majority stake in Qunar.com, a Chinese online travel search engine, part of Baidu's effort to expand its services in niche sectors. Baidu puts Qunar's search results on Chinese domestic flights on its results pages.

China Eastern takes full control of China United

China Eastern Airlines Co Ltd will make China United Airlines Co Ltd (CUA) a wholly owned subsidiary after acquiring the CUA shares it doesn't already own, according to a China Eastern statement on Thursday.

The transfer price of the shares - 20 percent of the total - will be 83.95 million yuan ($13.22 million). CUA is a civil and commercial airline based at Beijing Nanyuan Airport. The airline has 12 Boeing 737 aircraft and worked on freight and passenger transport between 50 cities in China as of June 2011.

Shanghai issues 8.9b yuan in local government bonds

Shanghai's government issued its first debt issue this year on Thursday with a total value of 8.9 billion yuan ($1.4 billion).

The bonds were split into two tranches. The five-year tranche with a yield of 3.25 percent saw a transaction-to-subscription ratio of 2.2 to1, while the seven-year tranche with a yield of 3.39 percent had a transaction-to-subscription ratio of 2.1 to 1.

In 2011, Shanghai's local debt bonds had a three-year tranche with a yield of 3.1 percent and a five-year tranche with a yield of 3.3 percent.

The 10-year central government bond with a total value of 30 billion yuan auctioned on Wednesday impacted the demand for the Shanghai bond. The treasury saw a bid-winning yield of 3.39 percent. Meanwhile, Zhejiang and Guangdong provinces and Shenzhen will also launch local government debt bonds in the near future, according to a report in the China Securities Journal.

Banks reduce foreign currency deposit rates

Industrial and Commercial Bank of China and Agriculture Bank of China will lower their interest rates for US dollar and euro deposits starting from next Wednesday, the two banks said on their websites.

The banks cut their interest rates for one-year US dollar deposits to 0.8 percent and cut the euro deposits rates to 0.7 percent.

Experts said the move reflects the changing outlook for the renminbi valuation.

As the US dollar and the euro appreciated against the renminbi in recent days, willingness to hold foreign currency has been on the rise, adding pressure to banks' related business.

Investment in culture, media industry declines

Investment in the culture and media industry fell in the first half of the year, according to a report released on Thursday by ChinaVenture, a research and consulting firm focused on venture capital investment.

Venture capital and private equity companies raised $78 million for 21 projects in the first half of 2012, a 68 percent drop year on year, the report said. Film, television, music and advertising accounted for almost all the investment, it added, in the first half.

Focus Media received a 100 million yuan ($15.80 million) investment in February for its taxi LED program, the largest financing in the industry by June. Interest remained strong in cartoon and animation investment.

China Daily - Agencies