Further property curbs expected

|

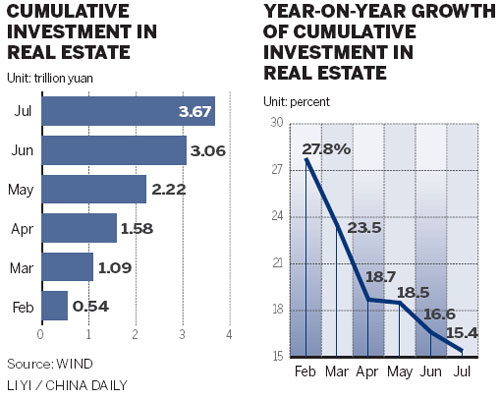

A salesman talks with potential homebuyers at a real estate fair in Qingdao, Shandong province. With the government making an effort to rein in the once-overheated property market, growth in investment in real estate development in the country slowed down in the first seven months of the year. Yu Fangping / For China Daily |

Authorities said to have lowered annual land supplies to 159,300 hectares

Officials in some provincial governments have already been given warnings by the central government that they are not adhering strictly enough to curbs and policies introduced to keep property prices in check.

According to reports, 16 inspection teams sent out in July to check whether policies were being followed are back in Beijing after gauging the scale of the recent property price upturn as a result of lax implementation of government policy.

The investigators are believed to be preparing their reports, and these are expected to shape future property policy, which is now widely predicted to see some further tightening.

The sending out of inspection teams was the result of what many are calling China's property market "spring", which has seen prices in some major cities, including Shanghai, Guangzhou and Beijing, showing early sign of a sharp "U" turn.

According to a report in Shanghai Securities News, citing a source close to a member of the teams, the central government has now given warnings to some local authorities who were found not to be following the original guidelines, with the aim of maximizing revenue from land sales.

The source said the inspection teams had been told that their main task was to ensure they strengthen the property market curbs already introduced.

The checks focused particularly on implementation of purchase controls, loan policies, land supply and management, taxation and tax management.

But he added that if housing prices continued to rebound, new policies will be introduced soon.

In a commentary on Monday in the Financial News, a newspaper published by the central bank, government officials were reported to be cautious about the possibility of cutting the reserve requirement ratios for banks, because it wants to keep the "spigot of funds" for real estate industry tight.

"The purpose of preventing further property price rises and industry bubbles is quite obvious," said the commentary.

Property market sources said they are already bracing themselves for firmer government action.

But they also said they didn't expect any new measures to be overly severe, as that would have too negative an effect on overall economic performance, already under pressure from dwindling trade and weakening domestic spending.

Xue Jianxiong, an analyst with China Real Estate Information Corp, predicted that two rounds of policy adjustment are likely to take place around October and November, and said that local housing authorities across the country can now expect stricter management by the central government on implementation of current policies, in wake of the recent price rebound in the housing market.

Xue suggested that regulators should first conduct internal examinations of how regulation systems are being managed and monitored locally, and make more specified and detailed policies to keep housing prices in check, particularly in Beijing and Shanghai.

He added that he expected to see an acceleration of public housing construction projects, and tighter controls on financing for homebuyers and developers.

And he expected, with prices projected to surge again in November, stricter policies over purchase controls and wider implementation of property tax to be introduced by the end of 2012.

"I am certain that decision-makers will curb rising housing prices," he said.

Land authorities have already started to cut land supplies in an effort to adjust the housing market, lowering land supply from 172,600 hectares planned at the beginning of this year to 159,300 hectares, according to a research note from Sinolink Securities.

Like Xue, it added that a property tax may be introduced if prices continued to climb.

In a separate research note, China Index Academy said it was unlikely for the central government to introduce any extreme policies.

Amid what it called a "complicated macroeconomic situation", decision-makers were unlikely to introduce policies that may "counter the efforts of maintaining growth", it said.

The Economic Observer, a weekly newspaper, said local governments will be keeping a close watch on any changes to land transfer fees. Such fees have contributed large proportions of their fiscal income in the past two years. But many local governments have already reported declining fiscal revenues in recent months due to shrinking fees from land sales.

Although the inspection teams' evaluations have not been fully completed, some warnings and alerts are believed to have been issued already to local government officials in Hunan, Hubei and Hebei provinces and in the city of Jiangmen, in Guangdong province, the source suggested.

Wang Juelin, deputy director of the Policy Research Center with the Ministry of Housing and Urban-Rural Development, China's real estate watchdog, said that July's nationwide checks were a lot more thorough than just checking on current implementation of policies.

He said that any warnings given to those not implementing the policies strictly as required, will result in reports being made to decision-makers to keep a close eye on their systems in the second half of the year.

He added that policy curbs on the property market must be strengthened.

wuyiyao@chinadaily.com.cn

(China Daily 08/14/2012 page13)