Major lenders broaden horizons and flex financial muscles

Major lenders from the world's second-largest economy are expected to accelerate their aggressive program of global investments of recent years, especially in the wake of the financial crisis.

Although still highly dependent on domestic business, all major players in the Chinese banking sector are predicted to strengthen their international positions - but market watchers are also cautioning that much still needs to be done to improve their chances of winning a larger share of the pie, faced with fierce foreign competition.

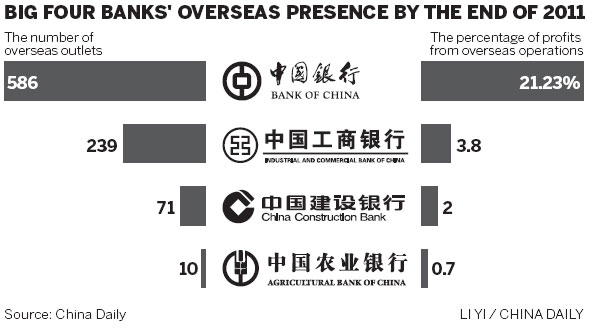

Figures reveal that from the end of 2008 to the end of 2011, foreign assets of the Big Four banks - Industrial & Commercial Bank of China Ltd, China Construction Bank Corp, Bank of China Ltd and Agricultural Bank of China Ltd - have mushroomed from 2.41 trillion yuan ($379 billion) to 4.13 trillion yuan.

"The internationalization of Chinese lenders will become inevitable and we see more mergers and acquisitions outside China by those banks as well as more overseas branches," said Guo Tianyong, director of the Research Center of the Chinese Banking Industry at the Central University of Finance and Economics.

He said that China's tight control over credit has been a dominant factor in this greater willingness to explore overseas.

Closer ties between Chinese banks and the international market after China joined the World Trade Organization in 2001 have also played a major part in increasing their chances of becoming truly future global players.

Dong Xian'an, chief economist at the Peking First Advisory Co Ltd, said the lenders' progress in terms of asset quality, profitability and liquidity against the rivals has helped accelerate the expansion of Chinese banks into international markets. He agreed that this is likely to be a continuing trend in the long term.

"However, Chinese banks are still in the early phases of internationalization and lag far behind their foreign counterparts," added Hong Qi, president of China Minsheng Banking Corp, a major private lender in China.

Hong said the capability of Chinese banks taking part in international competition requires them to play by universally applied rules, but their ability to up their game has been restricted in part by often complex and conflicting regulations at home.

"It makes no sense if banks go out just for internationalization, regardless of their own strategy and capability," he said, adding that his own Minsheng learned a hard lesson after loosing 900 million yuan on the acquisition of the US-based Wachovia Corp.

In September 2007, Minsheng's board of directors proposed buying a 19.9 percent stake in Wachovia, and the following year landed the deal for $887 million.

During the global financial crisis, Wachovia was hit with huge losses and Wells Fargo acquired it under a forced sale by the US government to avoid its collapse.

Starting in 2009, the Wachovia brand was absorbed into the Wells Fargo brand in a process that lasted three years.

BOC announced on July 23 to sell its Swiss unit to Julius Baer Group Ltd, Switzerland's largest private bank after having tried for four years to set up a private banking operation in the European country.

Weaker-than-expected performance was the main reason behind the move, said executives.

Compared with foreign counterparts, Chinese banks still have much to do to improve the performances of their foreign institutions, according to Thomas Chan, head of financial services for northern China at KPMG Huazhen, whose figures suggested that by the end of 2011, on average, foreign assets of major State-owned lenders accounted for 8 percent of their total assets.

Compare that with HSBC, for instance, which has 58.5 percent of its assets and 68.6 percent of its income coming from areas outside Europe, and Citibank, which has 52.3 percent of its income contributed by business outside North America, the figures showed what a challenge lies ahead for Chinese lenders.

Chan said the contribution of foreign business to total income of the major Chinese State-owned banks is an average 5.29 percent.

He added that the wider use of the yuan globally is already providing momentum for Chinese banks and Beijing's loosening of capital accounts to facilitate Chinese enterprises and individuals investing overseas is also creating larger demand for services provided by Chinese lenders.

Lin Zhihong, head of Minsheng's Hong Kong branch, said Chinese banks have played "an increasingly important role" in a series of overseas acquisitions conducted by Chinese companies around the world.

"Domestic enterprises and banks have large cooperation potential in terms of financial advisory services, project financing, settlement business and so on," he added.

ICBC, the world's biggest lender by market capitalization, has spent more than $6 billion on foreign acquisitions in the past three years, aiming to achieve a target of earning 10 percent of its assets and profits from foreign operations by 2016 against the current levels of 5.1 percent in terms of foreign assets and 3.2 percent in profits.

The lender's foreign assets increased by 64.7 percent year-on-year in 2011, while foreign pre-tax profit rose by 15.9 percent.

ICBC got approval from the US Federal Reserve last month to buy up to 80 percent of the Bank of East Asia Ltd's US unit for $140 million, the first time that a Chinese bank has been allowed to buy a majority stake in a local US depository institution, and it is waiting for approval to buy an 80 percent stake in the Argentine division of South Africa's Standard Bank Group Ltd for $600 million.

BOC, another major lender among the Big Four State-owned Chinese commercial banks, has also vowed to expand its foreign network, saying that it expects to become a truly world-class bank by 2020.

BOC used to be highly dependent on overseas services before it began exploring the domestic market at a rapid pace during the past decade.

Li Lihui, president of BOC, said that a 20 percent contribution of foreign business would be a well-balanced ratio.

In 2011, BOC set up 12 institutions abroad, while its foreign business made a profit of $4.6 billion, up 40.34 percent year-on-year.

Foreign earnings took up 17.3 percent of the group's total profit, 1.93 percentage points higher than a year earlier.

CCB, China's second-largest lender, aims to increase its contribution of profit from foreign branches from the current level of more than 2 percent to an ideal level of 5 percent by 2016.

The country's two other major lenders are still at the beginning phase of their globalization.

By the end of 2011, ABC reported foreign assets of 124.7 billion yuan, and profits of 887 million yuan from 10 foreign institutions. It got approval to set up institutions in Dubai, Vancouver and Hanoi last year, and set up a London subsidiary and a Seoul branch in February.

The Bank of Communications Co Ltd, meanwhile, already has 12 overseas operations contributing 7.2 percent of its total assets and 3.46 percent of profit in 2011. And both its foreign assets and profits increased by more than 38 percent from a year earlier.

Some experts cautioned, however, that Chinese banks should remain wary of the hard lessons learned by their Japanese counterparts as they headed to the global market in the 1980s and 1990s, when the world ranking of its banks slumped.

By 1991, six Japanese banks were ranked in the world's 10 largest commercial lenders by market value. And the top three were all Japanese lenders. But in 2011, none of the Japanese banks were on the top 10 list.

"They (the Chinese lenders) should try to avoid blind pursuit of scale, inefficient mergers and acquisitions and excessive expansion, to keep customer needs in mind constantly to enhance financial innovation and to manage risks prudentially," said Chan at KPMG Huazhen.

He added that lenders must be wary that their advantage of having a low capital cost base will disappear as interest rates liberalized.

Banking analyst May Yan, director of Barclays Capital Asia Ltd, said the lower profitability of foreign institutions compared with a China network always hinders banks' steps going forward.

"Lenders with a higher proportion of foreign business are usually less attractive to investors as their profit growth would be dragged down. BOC is a good example," she said.

But despite lower profitability, going abroad could well deliver some excellent opportunities, at some knockdown prices, Yan added.

In markets savaged by financial crisis, but now recovering, appealing takeover targets sit vulnerable to buyers with cash to invest: The timing could well be perfect for the Chinese banking giants to increase their footholds in various markets around Europe and elsewhere, she said.

wangxiaotian@chinadaily.com.cn

(China Daily 07/31/2012 page13)