Policy clarification required

|

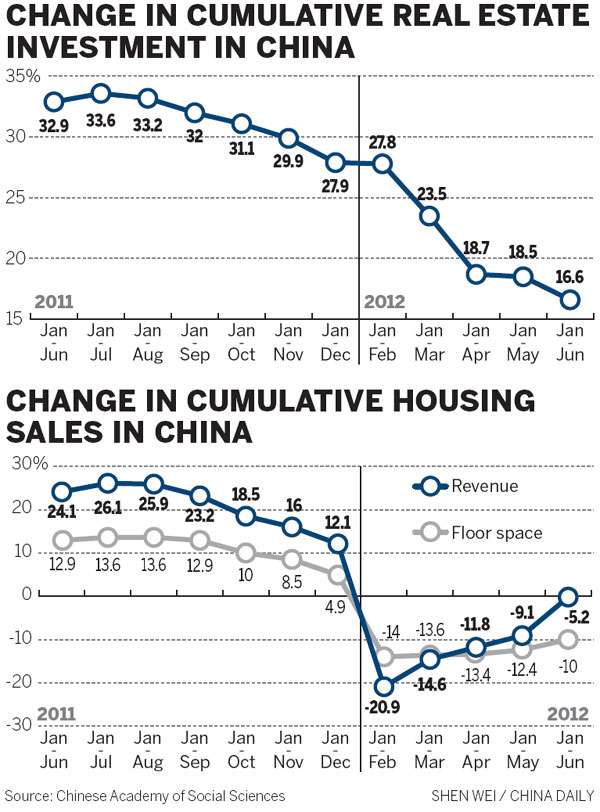

A construction worker at a housing project in Qingdao, Shandong province, on Wednesday. China's real estate investment grew 16.6 percent in the first six months of this year, compared with 32.9 percent growth in the same period last year. Yu Fangping / For China Daily |

Conflicting messages on macroeconomic targets and property control measures are adding to the government's challenge of stimulating economic growth in the second half of this year, a top think tank has warned.

The National Academy of Economic Strategy under the Chinese Academy of Social Sciences said in a report released on Monday, that the government should maintain its tighter property credit policy, but improve its current property policies in an effort to reverse the recent rising price trend, and prevent a "retaliatory rebound".

But Ni Pengfei, who chaired the writing of the report, said the most urgent need is to reverse some industry and public perceptions, which may have diverted attention from the central government's property control targets.

"This is not caused by the macroeconomic policy itself, but changing market expectations and panic purchasing by the public," Ni said.

Over the past month, data showed property prices gradually starting to reverse the falls of previous months, with slight rises in certain areas, giving ground to fears that the market - after a year-long freeze - might be starting to thaw.

Meanwhile, amid fears the economy may dip further in the second half of this year, China has cut interest rates twice within a month.

A sharp decline in real estate investment activity has also fueled expectations that Beijing might loosen the price curb policies in an effort to stabilize the economy in the second half.

According to the report, the moves may have reduced property developers' and homebuyers' lending costs, but they have also been interpreted by some as a signal the central government may be giving economic growth more of a priority than any further loosening of price controls, and this may harm performance in the second half of the year.

According to the National Bureau of Statistics, real estate investment grew 16.6 percent in the first six months of this year, compared with 32.9 percent in the same period last year.

The growth rate - significantly lower than the year-on-year growth of 20.4 percent in fixed-asset investment - dragged down overall economic growth to 7.6 percent in the second quarter, the slowest growth pace in three years

Local governments, fearful of the dwindling revenue from land transfers, have accelerated their move to loosen curbs.

Since the beginning of this year, nearly 50 cities have "fine-tuned" price curb policies, while some have been canceled altogether by Beijing.

The interest rate cuts, local fine-tuning, as well as a warm up in sales in May, have led to a quick switch in public expectations, resulting in some rushed buying, which have pushed up sales and prices.

In June, of the 70 large and medium-sized cities across China, sale prices rose in 25 cities over the last month. In May, only six saw an increase, according to the NBS report last week.

And in June, the national average prices of newly built residential houses rose 0.02 percent over May - the first time in the past eight months that the price has seen growth, NBS said.

In the face of these changes in direction, the CASS insists that more policies should be rolled out "as soon as possible", and government policies and expectations clarified.

"The central bank, while cutting interest rates, has maintained its previous policy that mortgage rates for homebuyers could be lowered to as much as 70 percent of the benchmark interest rate.

"This signaled a reduction in mortgage rates, and was the major reason for the change in market expectations," Ni said.

The CASS suggests that mortgage rates should not be lower than the benchmark interest rate.

It said that the mortgage rate for second-house purchasing should be raised to 1.2 times the benchmark interest rate, and loans should not be provided to third house buying.

Responding to market concerns that a tougher policy would dampen already flagging real estate investment, and jeopardize macroeconomic growth overall, Ni added that the growth in the third quarter should rebound, as there is still room for growth in consumption and infrastructure.

The CASS' suggestion of tougher property measures correspond to central government plans to "resolutely" keep the curbs in place.

Since early June, nine central ministries have voiced their resolution to keep a tight grip on the property market.

But some experts have also expressed doubt on too much reliance on administrative intervention to adjust the market.

Yang Hongxu, deputy director of the Shanghai-based E-house China Research and Development Institute warned that the curbs may backfire, as developers reduce supply of houses thus pushing prices up again.

zhengyangpeng@chinadaily.com.cn

(China Daily 07/24/2012 page13)