Index now in long-term upward trend

The Western analysis focus is on growth slowdown in China and its associated metrics, such as official and unofficial purchasing managers index figures. Official National Bureau of Statistics and China Federation of Logistics and Purchasing May PMI figures show a relatively high level of 55.2, while HSBC PMI figures show 48.7 for May.

The more significant figures are not the monthly PMI or the results of the planned slowdown in the economy. The most significant figure is 18 percent. That's the rate of growth in Chinese wages in the last 10 years. In Shanghai it is 14 percent, Beijing 21 percent, Shenzhen 20 percent and Guangdong 18.2 percent just in 2011. William Fung, head of Hong Kong's Li and Fung, predicts overall China's wages will increase 80 percent over the next five years

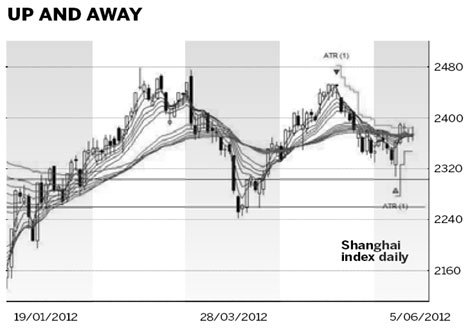

With more money in their pockets and the certainty of more to come, people begin to change their spending and consumption habits. It's a powerful and sustainable change than underpins economic stability. In China the increase in wages provides the fuel for a consumer-led recovery. The growth of domestic consumption and an increased demand for imported goods provide the foundation for sustainable economic growth. It is beginning to show up in the Shanghai index behavior.