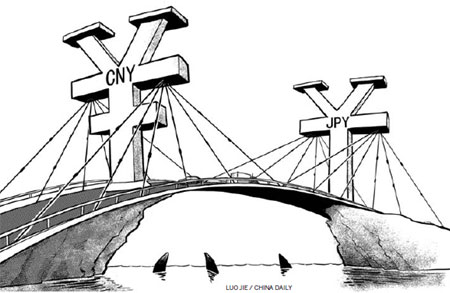

Another sign of Asian integration

Japan and China began direct yen-yuan trading on June 1. During Japanese Prime Minister Yoshihiko Noda's visit to China in December 2011, the two governments signed a number of financial cooperation agreements, one of which was to allow the direct trading of the yuan against the yen. This has multiple implications for bilateral trade and financial cooperation.

First of all, it can help avoid potential losses caused by exchange rate fluctuations. Previously, because the yuan is unconvertible in the capital account, trade between China and Japan was mainly settled in US dollars, with a small part settled in yen. Conducting transactions without using a third country's currency will help reduce transaction costs and lower the risks involved in settlements.

China's enterprises have an edge in low-price competition in foreign trade but have little experience in dealing with exchange rate fluctuations. Their slim margins usually are offset by exchange rate risks.