Oil bulls retreat as US production rises

Speculators slashed bullish bets on oil by the most in more than three months as drilling in the United States accelerated and output grew to the highest level since 1999, boosting stockpiles.

Money managers reduced net long positions, or wagers on rising prices, by 10 percent in the seven days ended April 3, the biggest drop since Dec 20, according to the Commodity Futures Trading Commission's Commitments of Traders report on Friday. Oil fell 3.1 percent in the week covered by the report.

Inventories surged by the most since 2008 and domestic production climbed to the highest level in more than 12 years in the week ended March 30, the US Energy Department reported on Wednesday. The US pumped 6.05 million barrels a day, an increase of 7.3 percent from a year earlier. The number of oil rigs grew 50 percent over the same period, according to Baker Hughes Inc, a Houston oil-services company.

"As production and inventory levels continue to grow, it makes it harder to be aggressively long at the higher price levels," said Phil Flynn, an analyst at futures-brokerage PFGBest in Chicago. "Market fundamentals are still quite weak."

West Texas Intermediate, the US benchmark, declined $3.32 a barrel to $104.01 a barrel on the New York Mercantile Exchange during the week of the report. Futures dropped another $2.19 to $101.82 on Monday.

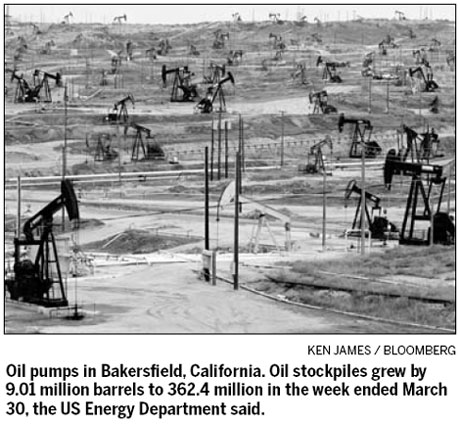

Oil stockpiles grew by 9.01 million barrels to 362.4 million in the week ended March 30, the biggest increase since August 2008, the department said. Stockpiles at Cushing, Oklahoma, the delivery point for New York futures, rose 729,000 barrels to 40.3 million, the most since May, the report showed.

Hydraulic fracturing

Producers have been extracting oil using the same technology that unleashed a surge of natural gas output and sent prices down to the lowest in a decade. They combine horizontal drilling with a technique called hydraulic fracturing, in which water, chemicals and sand are injected underground at high pressure to crack the rock and allow hydrocarbons to flow.

"We're in the midst of a crude-oil production renaissance in the United States," Stephen Schork, president of the Schork Group in Villanova Pennsylvania, said. "There's no reason to be bullish (West Texas Intermediate). There's a glut in the market."

US production gained for three consecutive years as producers looking to take advantage of higher oil prices accelerated drilling. North Dakota output almost tripled to a record 546,000 barrels a day in January from three years earlier, the Energy Department reported on April 2.

Midwest production

"There is clearly production increasing across the Midwest," said Andy Lipow, president of Lipow Oil Associates LLC in Houston. "You're seeing the full effect of the (hydraulic fracturing) technology reducing the cost and being put into use on a grand scale."

Continental Resources Inc, Chesapeake Energy Corp, EOG Resources Inc and Devon Energy Corp have expanded oil exploration in densely packed sands and shale. Devon plans to boost oil output by 22 percent to 24 percent in 2012, according to an April 4 investor presentation. The US Energy Department predicted that production will increase by 230,000 barrels a day this year, according to its March 6 Short-Term Energy Outlook.

The number of rigs drilling for oil advanced to 1,329 past week, the highest in records going back to 1987, according to Baker Hughes.

Weakening demand

While production has increased, consumption has weakened. Total fuel demand in the US averaged 18.2 million barrels a day in the four weeks ended March 30, down 4.7 percent from a year earlier, according to the Energy Department.

"Certainly inventory and demand levels have not been on the bullish trend," said Kyle Cooper, director of IAF Advisors, a Houston-based consulting firm.

Hedge funds reduced bullish oil wagers by 24,680 to 216,687 contracts in the seven days ended April 3. It was the lowest level since Feb 7.

Bloomberg News in New York

(China Daily 04/10/2012 page17)