Real estate market likely to see an increase in M&A activity

BEIJING - China will see more mergers and acquisitions in the real estate sector this year, with domestic players continuing to dominate the market, according to industry analysts.

The cash flow of property developers will be further squeezed as the credit policies relating to them remain tight and most of their financing channels, such as trust and overseas financing products, will come due this year.

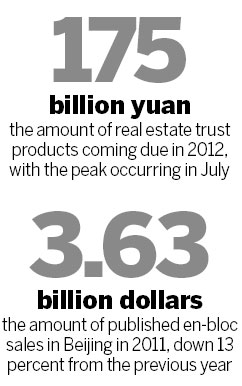

According to Guotai Junan Securities Co Ltd, real estate trust products valued at 175.8 billion yuan ($28 billion) will come due this year, with the peak occurring in July.

Ye Chengyu, director of investment at the real estate consultancy Cushman & Wakefield Inc, said that 2012 will be a year of property developer M&A, because they will face a tightened cash flow of unprecedented proportions.

"Though domestic players will still dominate the investment market this year, more deals involving international investors are expected," said Ye from Cushman & Wakefield.

According to Cushman & Wakefield, published en-bloc sales in Beijing hit $3.63 billion in 2011, down 13 percent from the previous year. Chinese institutional investors dominated the market in terms of sources of capital, with 83 percent compared with 60 percent in 2010.

However, the situation in Shanghai was the reverse: published en-bloc deals totaled $5.25 billion last year, up 9.9 percent from 2010. Foreign institutional investors accounted for 51.2 percent of the capital sources, according to statistics from Cushman & Wakefield.

"Shanghai remained the most-favored city by international investors, because the market is more mature and there are more tradable assets for global investors," said Ye.

Frank Marriott, senior director of Savills Real Estate Capital (Asia-Pacific), said the office markets in Beijing and Shanghai are still the favorites for international institutional investors, especially core real estate funds that prefer relatively lower risks.

"However, there are few investment opportunities for international funds in these two office markets because the supply is limited and competition is fierce," said Marriott. "Opportunist international funds are looking at the residential sector, seeking opportunities in second-tier cities with cash-strapped property developers."

Though there has been a capital outflow since October, Chris Brooke, president and CEO of CB Richard Ellis Asia, part of the CB Richard Ellis Group Inc, international investors still have a strong interest in the Chinese property market.

"Some international funds did sell their projects in China, but the major reason for that was that their investment period had come due, rather than any pessimism about the country's real estate sector," said Brooke.

China Daily

(China Daily 02/08/2012 page14)