Economics Special :Nielsen: 'Lower-tier' cities beckon retailers

Vast potential as home to 87 percent of the population

Driven by rapid urbanization and government efforts to stimulate domestic demand, China's smaller cities are emerging as a powerhouse for international and domestic retailers.

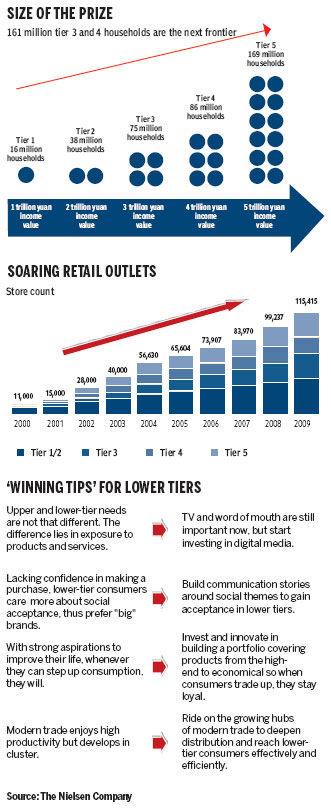

According to leading global information and measurement company Nielsen, lower-tier cities - county-level administrative areas that have both rural and urban districts - are home to 87 percent of the nation's population, but generate just 64 percent of retail sales. "The growth rate in lower-tier cities in the next few years will be twice what it is now," said Nielsen.

Some 52 percent of the population in 2015 is expected to be in urban areas, a figure that will grow to 65 percent by 2030, according a report by the Chinese Academy of Social Sciences.

By the end of 2009, the country's urbanization had reached 46.6 percent, with 620 million people living in cities and towns.

Xu Shanda, a member of the Committee for Economic Affairs at the Chinese People's Political Consultative Conference, said the government will implement a number of measures to improve the earnings of low-income families to strengthen their quality of life and purchasing power.

A proposal to raise the personal income tax threshold from 2,000 yuan to 3,000 yuan is the government's latest bid to boost domestic demand and will likely have a positive impact on consumer spending.

The China consumer confidence index jointly compiled by Nielsen and the China Economic Monitoring & Analysis Center (CEMAC) of the National Bureau of Statistics showed the country had a score of 108 in the first quarter this year, up from 100 in the fourth quarter of 2010 and the highest level since 2009.

Consumer confidence rebounded in the first quarter of 2011 as inflation concerns eased and people's willingness to spend increased after a slide in the previous two consecutive quarters.

Nielsen and CEMAC surveyed more than 3,500 shoppers across China's cities, towns and villages. According to the data organized by city tiers, confidence among consumers in the rural areas continued to strengthen, up 6 percentage points to 113, near the record high set in 2009.

"The good news is that income is rising faster than inflation, particularly in rural areas. We continue to see strong growth in market demand, even in discretionary categories," said Nielsen.

China's rapid economic expansion has boosted the retail market as it led the Asia-Pacific region in retailing growth in the last decade - when the number of stores grew by more than 1,000 percent.

With 3.3 million outlets across the country, China is now the second-largest consumer goods retail market in the Asia-Pacific region.

According to Peter Gale, Nielsen's managing director of retailer services in the Asia-Pacific, the Middle East and Africa, China has transitioned faster than any country ever due to the unprecedented investment in new stores. But growth has slowed in major cities as the retail scene matures.

"The new growth opportunities are now the lower-tier cities and this is where retailers are investing more in new stores," said Gale, adding that the leading chains have already switched their attention and have more than 60 percent of their stores in smaller cities.

In the past nine years, modern trade grew 10 times, with the growth mainly coming from small cities and towns instead of large metro areas, according to statistics from Nielsen.

Issues to face

But issues facing companies looking to expand to lower-tier cities are numerous: How to win market share? How do they identify the cities with the highest growth potential? How can they win shopper loyalty? What store format strategy should they adopt? And what are the most effective marketing mix strategies?

Retailers should think about the city's purchasing power, GDP, household disposal income and population. Other factors are also important when considering a city, including proper strategic partners, retail sales and growth, clear development plans by local governments, available support from trade associations and local retailer alliances.

Compared with big metropolises, pricing may not be the top priority as competition is currently less keen in smaller cities.

"Retailers should focus on building brand awareness and shopper loyalty as well as price positioning. But being price competitive on daily necessity items is still very important," said Nielsen.

Meanwhile, understanding the needs of shoppers is critical to winning in the long term, and even more so in smaller cities.

Shoppers from different city tiers have different behaviors and needs. Food categories, for instance, particularly need to cater to local preferences.

"Retailers should seize the opportunity to introduce new trends and products from higher-tier cities. But they cannot forget the importance of local favorites. They also need to be flexible with respect to store format when entering a lower-tier city," said Nielsen.

Retailers need to become the shopper's "best friends and neighbors" as consumers in lower-tier cities place a strong emphasis on interpersonal relationships.

Online retailing

Online retailing is also growing across Asia. In China, Taobao dominates online shopping with a 75 percent share of the market, but competition is increasing. Wal-Mart has announced plans to offer online shopping, while Tesco is aiming to drive online sales in more markets.

According to a Nielsen survey, 95 percent of Internet users in South Korea and China say they intend to make an online purchase in the next six months, and more than 40 percent of online shoppers in these two countries claim they will spend more than 10 percent of their total shopping expenditures online.

The opportunities in China's lower-tier cities go beyond the fast-moving consumer goods retail market. Recent Nielsen surveys have found the cities are ripe for expansion in several areas, particularly the automotive sector, where many consumers will have the money to become first-time car buyers.

The financial services sector is also looking to these cities for expansion as greater consumer affluence is driving demand for new financial products.

Consumers in towns and smaller cities are also eager to travel. While Shanghai, Beijing and Guangzhou tend to dominate, the enormous potential of China's other cities is finally spreading. Regardless of the sector in which they operate, companies looking for the "next big thing" are increasingly focusing beyond tier-one cities.

The author is the managing director of The Nielsen Company Greater China

(China Daily 06/01/2011 page14)