How Greece threatened euro's future

Book review | Matthew Lynn

May Day 2010. The International Monetary Fund (IMF) and the European Union (EU) were putting together the final details of a $100 billion euro rescue package for the country. The Greek Prime Minister, George Papandreou, had agreed to a savage package of "austerity measures" involving cuts in public spending and lower salaries and pensions. Outside, riot police were deployed as protesters gathered to fight the austerity program. A country with a history of revolution and dictatorship hovered on the brink of collapse - with the world's financial markets watching to see if the deal cobbled together would be enough to both calm the markets and rescue the Greek economy and, with it, the euro from oblivion.

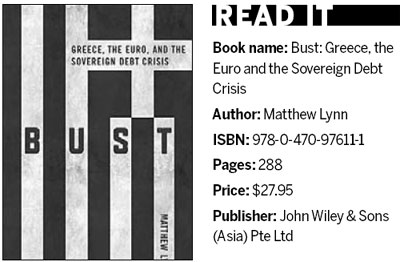

In Bust: Greece, the Euro, and the Sovereign Debt Crisis, leading market commentator Matthew Lynn blends financial history, politics, and current affairs to tell the story of how one nation rode the wave of economic prosperity and brought a continent, a currency and, potentially, the global financial system to its knees.