Mainland shares continue bull run

|

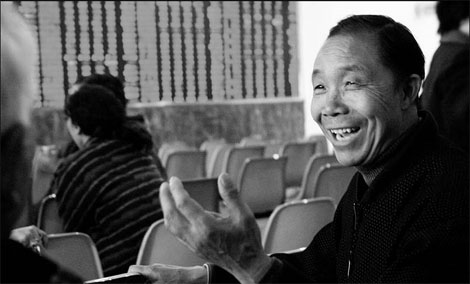

Investors at a brokerage in Wuhan, Hubei province. Mainland stocks have seen gains for five days. Jin Siliu / for China Daily |

Sustained optimism over economic growth keeps equities buoyant

SHANGHAI - Mainland stocks rose for a fifth day, extending the benchmark index's bull market rally, after exports climbed last month and China's government said it will promote sales of construction material in rural areas.

"China's economy will grow steadily as there's no major worry over a big slump in external demand," said Zhang Ling, a fund manager at Shanghai River Fund Management Co. "The market is becoming more optimistic about the economy, so defensive stocks like consumer shares have seen money rotating out of them."

The Shanghai Composite Index rose 19.95, or 0.7 percent, to 2861.36 on Wednesday, and the CSI 300 Index added 1.41 percent to 3217.58.

The nation's exports rose 25.1 percent from a year earlier and imports climbed 24.1 percent, according to information on the customs bureau website.

The third-quarter trade gap was $65.6 billion, the most since a $114 billion surplus in the final three months of 2008. The country posted a $16.9 billion trade surplus for September, capping the largest quarterly excess since the economic slowdown in 2008 .

China will start trials of a program to promote sales of construction materials, focusing on cement, in rural areas, the Ministry of Housing and Urban-Rural Development said on Tuesday.

China will become "extremely cautious" in raising rates in order to prevent hot money inflows and to control the pace of yuan appreciation, Zhang Monan, a researcher with the State Information Center, wrote in a commentary published in the China Securities Journal newspaper.

Automakers gained after China's passenger-car sales to dealerships quickened in September. Wholesale deliveries of passenger cars rose 19.3 percent to 1.21 million, accelerating from 18.7 percent in August, according to data from the China Association of Automobile Manufacturers.

The Shanghai Composite is Asia's worst performer this year, with a 13 percent decline through Tuesday as the government boosted measures to slow the economy and cool property prices.

At the same time, Indonesia's Jakarta Composite Index rallied 40 percent, Thailand's SET Index jumped 33 percent and Malaysia's FTSE Bursa Malaysia KLCI Index rose 17 percent.

Mainland stocks will extend their rally as investors increase purchases in a market that lagged behind gains in Asia, according to Templeton Asset Management Ltd's Mark Mobius.

The Shanghai index's rise above its 200-day moving average is a "positive sign" that signals further gains for the benchmark gauge, according to Schaeffer's Investment Research.

Bloomberg News

(China Daily 10/14/2010 page16)