Fixing the US financial system

During the past 18 months, dozens of authors have produced books about the 2007-2009 financial crisis. Two of these books illustrate well the broad choices a reader has: You can spend your time being entertained, picking up some color about the people playing important roles and how they influenced events, or you can learn something about the underlying causes and effects in an interesting, approachable way.

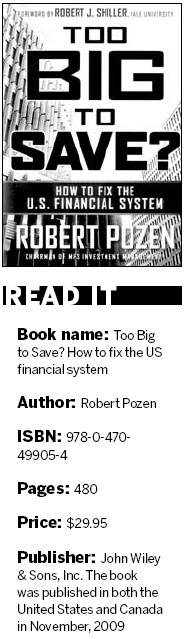

In "Too Big To Fail", author Andrew Ross Sorkin, a New York Times reporter, supplies a rollicking, well-woven, at times profane "insider account" of daily events before and during the financial crisis. In "Too Big To Save?" author Robert Pozen, senior lecturer at Harvard and chairman of an investment firm, methodically examines and evaluates the US government's response to the crisis, explains concepts, and suggests reforms to prevent another one.

It is clear that Sorkin interviewed nearly every significant figure in the financial crisis and had access to calendars and correspondence. At times clearly one-sided in his characterization of the players, he describes in detail (with full, multi-party quotations) events such as the chaotic situation on a mid-September Sunday when Lehman Brothers was sinking before its management's - and the government's - eyes. He tells how Henry Paulson, then US Secretary of the Treasury, vomited after one excruciating meeting. He even recounts what John Mack, chairman of Morgan Stanley, told his wife just before they went to bed one night. Meanwhile, the reader must somehow hope to discern, from among all of the beguilingly precise details and quotations, truth from embellishment in the storytelling.

In focusing on details and actions of specific people, Sorkin implicitly subscribes to the "Great Man" theory of history - studying history by examining the particular personalities involved. It is undoubtedly true that individual foibles and prejudices help determine the outcome of events, whether they be military battles or bailing out banks. Would the course and outcome of the financial crisis have been different if, for example, instead of the intervention-oriented Henry Paulson, President Bush had still been served by Paulson's reflective predecessor, Treasury Secretary John Snow, who had sounded the alarm in 2004 about the housing market bubble and advocated action against the excesses of Fannie Mae and Freddie Mac? Sorkin does not address this sort of question, so one is left wondering.

Sorkin is a newspaper reporter and has written a book in that vein: He does not consider the institutional and structural pressures that existed and contributed to the crisis. Only in his epilogue does he briefly touch larger issues for the future, without delving into policy issues of regulatory reform.

Where to turn for explanations and analysis? A superb, thorough, and approachable treatment of policy issues and suggestions for solutions, Pozen's book is an essential tool for understanding the financial crisis. He carefully assesses each governmental response and suggests many ways to improve the design of financial regulation. For example, in his first 100 pages, Pozen deals with the housing finance market - how the housing bubble grew and the policies that contributed to it, including the securitization of mortgages through Fannie Mae and Freddie Mac. He also explains in easy-to-understand terms how credit derivatives work and identifies nine characteristic mistakes in using financial models.

In the course of the crisis, the US Treasury injected taxpayer funds into more than 600 financial institutions, a number so incredibly high that it cannot possibly support a coherent theory of "too big to fail". Pozen argues persuasively that Congress should establish narrow criteria for bailing out banks and then apply the criteria (if at all) in a disciplined and transparent process. Here, Pozen could come down harder on the moral hazard created by "too big to fail", which is ultimately a flawed policy that should be avoided.

Pozen assesses the crisis through his compelling concept of one-way capitalism. In his view, US taxpayers shouldered most of the risk of loss in rescuing financial institutions, but did not bargain for enough of the potential benefit. For example, in late September 2008 Warren Buffett received 100 percent warrant coverage when he purchased Goldman Sachs' preferred stock. Two weeks later, the Treasury received only 15 percent warrant coverage for its purchase of Goldman's preferred stock. Pozen carries this argument too far when he suggests that the Treasury should have bought common, rather than preferred, stock in troubled institutions. For example, GMAC is a troubled bank that historically financed automobile loans, but diversified into residential mortgages, too. A series of bailouts has left the Treasury today as a reluctant and inexperienced 56 percent common stockholder, where it bears the risk of management's decision making without taking an active role in directing the company. An active role is out of the question, because in our dynamic marketplace, politicians and bureaucrats cannot run companies very well, nor would we want them to try. So a preferred shareholding would better reflect the true nature of this relationship.

Pozen writes as the Harvard teacher he is - patiently leading readers through the important aspects of the financial system that contributed to the financial crisis. Each chapter ends with a summary and several diagrams to illustrate how complex concepts actually work. His review is not just focused on the US.

(China Daily 05/10/2010 page17)