Lu explodes myths of China's growth

|

Lu Zhongyuan, vice president of the Development Research Center of the State Council Guan Xin |

Suppose we take a patient to a doctor of traditional Chinese medicine. And then we take him to a practitioner of Western medicine. Their diagnoses are most likely to be different.

Now, suppose the patient is the Chinese economy. How would one from the West diagnose it?

Highly dependent on exports, or downright mercantilism.

Very little domestic consumption. "Asians always save and never spend," as the saying goes.

Government investment plays a very big, if not unnecessary, role in the economy.

All these, however, are "China myths" propagated by some people from abroad, says Lu Zhongyuan, vice-president and a senior researcher with the Development Research Center of the State Council (China's cabinet).

Instead, argues the economist, what has created a huge room for change for China is its urbanization index, which is lower than even many other developing countries. As the urbanization drive expedites, Chinese consumers will spend more and their demand will make economic growth sustainable well into the next decade.

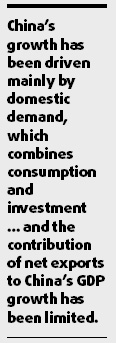

"China's growth has been driven mainly by domestic demand, which combines consumption and investment," says the economist who has studied in both Harvard and Oxford universities. "And despite its impressive volume of foreign trade, the contribution of net exports to China's gross domestic product (GDP) growth has been limited."

From 2001 to 2007, Lu says, net exports contributed 0 to 2.5 percentage points to GDP growth, which incidentally was around 10 percent a year.

In 2007, when GDP growth was 11.9 percent, net exports contributed only 2.3 percentage points to it. In 2009, China's exports contributed none to GDP growth because exports were estimated to have fallen 17 percent, and still the Chinese economy exceeded its target of 8 percent increase.

'Theirs is a wrong conclusion'

That being the case, "it's hard for me to understand why some people see China as following an exports-led growth model", Lu says. "Theirs is a wrong conclusion."

The flood of low-end "made in China" goods in almost every shop around the world has made observers believe that the country's exports accounted for a large percentage of its total GDP. Some even blame China's large-scale exports for the imbalance in the world economy.

Pointing out the fallacies in such arguments, Lu says the problem lies in the pattern of the global supply chain and the international division of labor. It's true that China has a competitive advantage in low-end industries because of cheap labor and land. "We do export a lot, but it is not our fault."

"The international division of labor is led by multinational companies in developed countries. Only if its pattern changes can we solve the problem of China exporting a lot," says Lu.

Now let's see if China's exports are indeed behind the imbalance in the world economy. China's exports accounted for 5.9 percent of the world total in 2003 and 9.1 percent in 2008 according to World Trade Organization data, while those of Germany took up 10.2 percent and 9.3 percent, those of the United States, 9.8 percent and 8.2 percent respectively. And in 2007, China exported 5 percent of the total exports of high-income countries.

"So why not say exports from high-income countries, or Germany, have created the imbalance?" Lu questions.

There is some problem with the statistical methods used in international trade, Lu says, because they exaggerate the role of exports in China's economic growth.

While measuring a country's dependence on foreign trade, a vast majority of economists concentrate on a simple but misleading figure: exports-GDP ratio. Since exports are defined as the total turnover and GDP measured in value-added terms, the exports-GDP ratio actually compares two incompatible things.

Lu cites an example to explain this incompatibility. The cost price of an iPod made in and exported from China is about $150 and its retail price, $300. But China gains only $3 to $5 as processing fees for making and exporting an iPod. That leaves more than $140 of added value to say Japan or any other country selling the product. So how can people blame "made in China" products for the imbalance?

'Consumers elevate spending'

A renowned economist who has won a number of top domestic prizes in economic research, Lu has always pursued "objective, cool-headed, fair, and scientific" research and endevored to help the country achieve healthy economic development instead of fanning trendy sayings to woo the public.

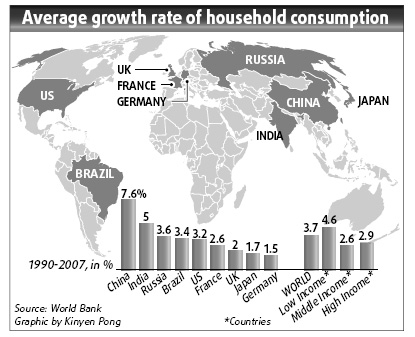

Unlike many economists who think China's consumption lacks vitality and its consumers have not loosened their purse strings enough to help the world economy, Lu says the opposite is true.

"Chinese consumers have kept increasing their spending They are elevating their consumption to a much higher and far costlier level, which is conducive to economic growth."

Forty years ago, when Lu joined a national campaign for young intellectuals to be an agricultural worker on a farm in Heilongjiang province after leaving his Beijing home, even a radio was a luxury for a Chinese.

Thirty years ago, when economic reform began in earnest and he became one of the first groups of college students, the best buys were bikes and watches. Twenty years ago, when Lu got his doctoral degree in economics from the CPC Central Party School, color TV sets and refrigerators were considered the best of consumer products.

Ten years ago, when he started work at the State Council's Development Research Center, people were shopping for mobile phones and computers. Today, Chinese consumers are buying cars and houses. And yet some economists say Chinese do not spend.

Chinese consumers bought about 13 million vehicles last year - the highest in the world. And sales in the real estate sector rose by as much as 35 percent in the first three quarters of the year.

"Remember," Lu says, "a Chinese consumer has to spend about 100,000 yuan for a car and about 1 million yuan to buy an apartment."

Ordinary Chinese need to save for years or decades to fish out such huge amounts. They have to save just to pay the installments. "How can one still say China's consumption lacks vitality?"

Some multinationals, however, have accepted the truth. At a recent forum, Lu was told by executives of some multinationals that they were not only increasing their input in marketing in China, but also in research and development. The reason: rise in the level of consumption.

Further increase in China's domestic demand, Lu says, depends on how fast consumers' incomes grow. He believes China's economic growth is sustainable and accordingly it will expand the job market, especially in the emerging cultural, healthcare and environment sectors.

But what happens to the migrant workers who have lost their jobs in the coastal areas? Lu says they could be relocated to small- and medium-sized cities in the country's inner provinces to propel the urbanization drive.

'Sound balance for growth'

China has seen a generally sound balance among consumption, investment and net exports between 2004 and 2007 in its domestic growth.

Last year, however, investment's contribution to economic growth is likely to have already outpaced consumption due to the country's 4-trillion-yuan ($585.6 billion) stimulus package. But a large portion of the 1.8 trillion yuan ($263.6 billion) allotted by the central government has gone to residential housing projects for the lower-income groups.

Another part of the package has gone into ecological construction, water conservancy and pollution-control projects. "The input in infrastructure is far less than 80 percent as claimed by many," Lu says. "And the more the investment in technological development, the better."

For the whole of 2009, "investment and consumption have made up for the loss of net exports in driving recovery," he says.

As an adviser to China's top policymakers, Lu focuses on sustainable economic growth rather than academic awards.

"The inner developing need of the economy demands that its investment rate maintains a fast pace in the long term because China's industrialization will not be complete until the 2030s," he says.

His study of transitional economies as a visiting post-graduate at Oxford University and a short-term program at Harvard University have broadened his insight, but unlike the UK or the US, China has to deal with a large population, many of who are still poor.

Yet "China still has a lot of room to maneuver in its urbanization drive", because its urbanization rate, according to the World Bank, was 42.2 percent in 2007, compared to Brazil's 85.1 percent and Indonesia's 50.3 percent.

The accelerated urbanization process will be seen not only in the increase in the urban population, but also in the country's massive accumulation of fixed assets and infrastructure construction. All these will provide a strong material foundation for growth.

"As industrialization and urbani-zation both speed up and more residential units are sold, domestic demand will push economic growth in the future," Lu says.

(China Daily 01/07/2010 page9)