Debate: Trade wars

Editor: The visit of US President Barack Obama to China next month assumes special significance because of the trade disputes between the two countries. He Maochun, professor in Tsinghua University, tells China Daily's Lan Lan how governments and industrial associations can help avoid such disputes, while a leading bank's analyst writes how China is likely to react to fresh tariffs on its steel pipes.

Give reason a chance andindulge in fair practice

The Barack Obama administration is testing the strength of China's economy by imposing unjustifiably high tariffs on its products, reflecting the immaturity of its trade policy. Given the current state of affairs in the United States, Sino-American trade disputes are likely to intensify. But, says He Maochun, professor in the Institute of International Studies of Tsinghua University, Obama should think twice before upsetting the deeply intertwined bilateral interests further.

Last month, Obama imposed tariffs of up to 35 percent on China-made tires. Later, the US government announced that an anti-dumping investigation could increase the duty on made-in-China steel pipes to as much as 98 percent. Such high duty will price Chinese producers, who export labor-intensive goods with low profit margins (an average of about 5 percent), out of the market, He says.

Indeed, Obama is facing a number of challenges at home, including the unemployment crisis and resistance to his healthcare reform plan. So he wants to get the support of the voters that workers' unions represent and, after weighing the pros and cons, has chosen to placate the unions.

To put it simply, Obama has made a bad start on the Sino-US trade front by ignoring the reaction of a major trading partner like China. This will only help increase Sino-US trade conflicts, for more American interest groups will seek similar protection from their president. The result: the US administration could target more Chinese enterprises, forcing them to cut jobs.

There is also the fear that other countries would start following the US example, giving rise to trade disputes not only on anti-dumping and anti-subsidy tariffs but also in areas such as anti-monopoly and intellectual property rights protection.

China has responded to the excessive and unjustified tariffs by filing a complaint with the World Trade Organization (WTO), saying it could impose duty on poultry products and auto parts imported from the US. Nevertheless, China has always tried to avoid trade disputes with the US, or for that matter any other country. The reason for that is simple: Such disputes hurt both sides.

Despite the trade conflicts, Sino-US ties are at an all time high, He says. And though occasional disputes and lawsuits are normal in trade partnerships, Obama should ensure that cases like the tariff conflict do not recur. If they do, the US president can be seen as leading bilateral ties along the wrong course.

As the world's biggest creditor and an important destination for US investment, China holds the bargaining chips in the trade disputes. The US needs China's support in talks with the Democratic People's Republic of Korea and Iran on nuclear issues, too.

China is a rapidly rising economy and an vital player on the global stage, which makes it very important for the US foreign policy. Hence, Obama can be expected to shift to more pragmatic economic policies toward China. He can do so by first preventing the trade war from escalating by stressing the interdependence of the two countries.

Besides, Obama's trade policies toward China are important for Beijing, too. And to achieve an ideal Sino-US trade relationship, Beijing is striving for two things: for Washington to recognize it as a market economy and lift the restrictions imposed on export of hi-tech goods to China.

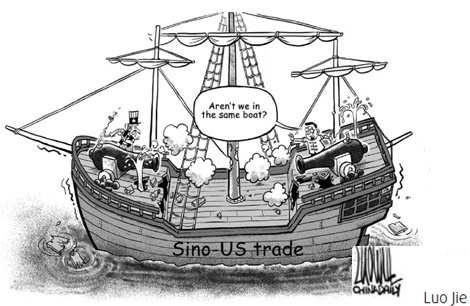

China and the US are in the same boat when it comes to matters of the economy. And sailors on a boat have to work for mutual benefits to prevent it from sinking and sailing ahead.

The next vital question, He says, is how Chinese exporters can avoid frequent anti-dumping allegations and surveys in the US, the European Union states and other countries.

China should rethink its position in the world market and act like a trustworthy global leader, shouldering more responsibilities. It has replaced Germany as the world's largest exporter and could overtake the US as the world's largest importer in the next few years. The Chinese government is trying to boost domestic demand, and succeeding in its efforts, to shift its reliance on exports for economic growth. This has made imports a driving force of its economy.

Many international experts no longer consider China as a developing country. Hence, China should impose stricter demands on itself to abide by WTO agreements and rules, without citing the excuse of still being in a transitional period, He says.

In terms of WTO rules, more work needs to be done. For instance, there's plenty of room for China to improve the quality and certification system of it products and enhance their market transparency. In this regard, industrial associations representing Chinese exporters' interests have to play a bigger role than they have done so far.

Thousands of small businesses across the country have to do everything possible to avoid trade conflicts because they cannot afford to pay the exorbitant legal fees for hearings on global trade disputes and it's very difficult for them to negotiate with related global associates.

The domestic industrial associations have failed to deliver the goods, He says. Most of them are made up of retired government officials who have never run a company or were never involved in exports. The officials thus lack the experience of exploring the overseas market.

So it is important that Chinese enterprises are allowed to elect their own industrial associations, associations that can really serve them and take more effective actions.

Plus, the industrial associations have to establish a mechanism to ensure long-term dialogues with overseas unions to avoid trade disputes. They should study the competitiveness and other factors of a market that Chinese exporters want to enter, and be able to forecast to what extent imports can grow.

Disputes not likely to lead to full-blown trade war

The US Department of Commerce's announcement on Oct 7 that it would launch an investigation into imports of seamless steel pipes from China had a sense of dj vu about it after the Barack Obama administration imposed punitive tariffs on China-made tires last month.

The announcement raises worries that more protectionist actions would follow, leading to a trade war between the two giants of world trade. China has responded to the tire tariff by filing a complaint with WTO and by launching its own investigations into imports of US poultry and auto parts. China has so far not responded officially to the US' investigation into seamless steel pipes.

The impact of actual and potential trade actions on tires and steel pipes is low. The US investigation could potentially lead to imposition of 98.7 percent duty on China-made seamless steel pipes. But as in the case of China's tire exports, the potential damage to seamless steel pipes exports for China is rather low.

China's exported $382 million worth of seamless steel pipes to the US last year, which accounted for 0.02 percent of its total exports. The value of Chinese tires export to the US is small and insignificant, too, at less than 1 percent of its exports to the US and less than 0.15 percent of its total exports. On the macro scale, the tariffs will barely make a dent on China's overall export performance.

Nevertheless, the US Department of Commerce has said that imports of Chinese seamless steel pipes rose 218 percent in terms of value and 132 percent in terms of volume (tons) from 2006 to last year. The US investigation announcement came shortly after a decision by the European Union (EU) to impose anti-dumping duties on the same category of imports from China.

The recent US actions appear motivated by domestic politics. In the case of China's tire imports, President Barack Obama's decision came after the United Steel workers union had filed a safeguard complaint against them. The union is a strong constituency for Obama, and he has been seeking its support for his healthcare reform plan.

Investigation into China's seamless steel pipes also appears to have been motivated by similar considerations. The surge in imports of Chinese tires and seamless steel pipes has been blamed for job losses in US factories.

There is a risk that more similar complaints and actions on both sides could spiral into a trade war. The success of the United Steel workers will spur other US sectors to follow suit because of the difficult employment situation in America. The current recession is by far the most severe in terms of cumulative job cuts: more than 7.2 million.

If more safeguard complaints against Chinese imports are filed to preserve US factory jobs it will heighten bilateral tensions. Despite the low economic fallout of the US' tariff move, China will have to protect the interests of its producers and workers.

This is a year when China's real GDP growth will slow significantly, and its companies have been cutting costs and jobs. The Chinese government is very sensitive to any possible build-up of social discontent and will go to great lengths to keep social harmony intact, and hence could retaliate with similar trade action or through other means such as verbal intervention on its purchase of US Treasuries.

Such a chain of events is obviously undesirable and will result in several negative consequences for both sides. China-US bilateral trade is substantial at more than $400 billion (2008 figure). Trade with China accounts for about 12 percent of total US trade, while China's trade with US accounts for 13 percent of its total. Thus if the trade dispute spreads to other sectors, it will have a substantial negative impact on global trade, which is already projected to contract by about 10 percent this year.

The difficult employment situation makes more trade disputes possible, but a full-blown trade war seems unlikely. Leaders of the two countries will have to protect and create jobs in their countries. The pressure of a difficult job market will not go away anytime soon, and this will translate into complaints of unfair trade practice by other countries. Therefore, leaders of the two countries will to a certain extent have to dance to the tunes of their domestic constituents.

But they seem to recognize the high cost of a full-blown trade war. The cases that the US has acted upon have so far been those with low impact. This indicates that the Obama administration will choose its cases strategically to appease its constituents, but it will be careful, too, not to inflict significant damage to bilateral trade.

Though more complaints being filed or other trade-related actions cannot be ruled out by either side, we can expect future cases to be limited to those that serve the purpose of advancing the domestic political agenda.

On a one-year horizon, it is unlikely that cumulative trade actions by the US will amount to more than 1 percent of China's total exports. The Chinese leaders will be reacting to US actions as strongly as they need to in order to deter the US from taking more such moves. But we believe that they are not going to cast new stones at the US, considering their intertwined economic interests.

China is one of the US' key financiers by virtue of having large holdings of US Treasury bills, and it will clearly benefit from the recovery of the US economy.

The author is an analyst with Deutsche Bank AG.

(China Daily 10/20/2009 page9)