Worst over for Aussie dollar

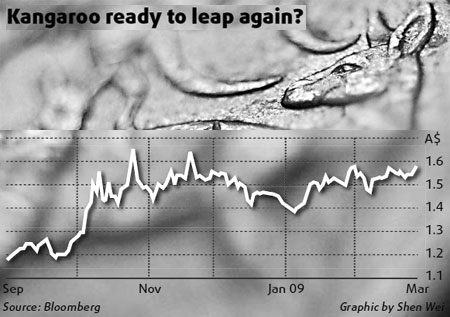

The worst is over for the Australian dollar, derivatives show, after the currency dropped by a record 21 percent in 2008.

The so-called Aussie will remain above last year's five-and-a-half year low, according to the so-called risk-reversal rate on one-month Australia-US dollar options. The rate rallied to a six- month high of minus 1.37 at 4:36 pm in Sydney, after dropping to a record on Oct 27 when the currency slid to 60.10 US cents, its weakest since April 2003. Negative values show more demand for options to sell a currency than for options to buy it.

The market's "priced out the risk of a downward jump because the assumption is commodities demand and overall Asian demand will not be extremely poor," said Sebastien Galy, a currency strategist at BNP Paribas Securities SA in New York. "In the short-term, I don't expect the Australian dollar to go much beyond 62 US cents on the downside irrespective of the very bad data we've had."