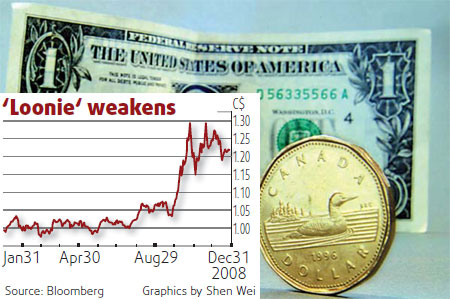

Canadian dollar set for more bad times

China Daily | Updated: 2008-12-31 07:52

Canada's currency may extend its biggest annual decline on record, as tumbling crude prices hobble foreign investment in the country's oil patch, according to the world's biggest strategists and economists.

The Canadian dollar fell 18 percent this year as a global recession cut demand for commodities, which generate half the country's exports. Canada's current-account surplus, the broadest measure of trade, will turn into deficit in 2009, said Toronto-based Scotia Capital Inc, a unit of Canada's third-biggest bank.

"A scaling back of foreign direct investment is a negative for the Canadian dollar," said Eric Lascelles, chief economics strategist in Toronto at TD Securities Inc., a unit of Canada's second-largest bank.

Photo