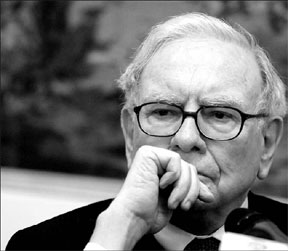

Buffett's instant paper profits plummet

Billionaire investor Warren Buffett's instant paper profits on Goldman Sachs Group Inc and General Electric Co have been wiped out amid the stock market's worst yearly slump since 1937.

Goldman, the most profitable Wall Street firm, fell 7.3 percent on Tuesday in New York trading to $115, the price at which Buffett can buy $5 billion of shares at any point in the next five years. When the deal was announced last month, Goldman closed at $125.05, meaning Buffett was $437 million ahead.

Goldman and GE also sold Buffett a combined $8 billion in preferred shares that pay a 10 percent dividend, allowing his Berkshire Hathaway Inc to earn $800 million a year without the warrants unless the companies collapse. In exchange, the firms got Berkshire's cash and the endorsement of the "Oracle of Omaha" at a time when stock prices are falling on concern that a tightening credit market may hobble even the largest companies. Buffett "doesn't have a two-week time horizon," said Frank Betz, a partner at Warren, New Jersey-based Carret Zane Capital Management, which holds Berkshire and GE shares. "Just because these prices drop below the strike price, it doesn't suggest that either of them are not exceptionally good investments." GE, the world's biggest maker of jet engines, agreed on Oct 1 to give Berkshire warrants to purchase $3 billion in shares at $22.25 apiece. The stock, which closed at $24.50 that day, dropped to $20.30 on Tuesday.