Dimon rises as Wall St tumbles

|

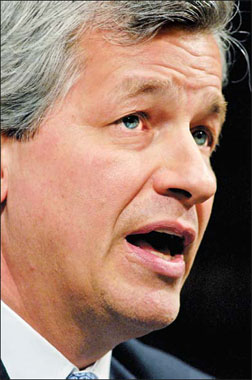

Jamie Dimon |

With the acquisition of Washington Mutual Inc, JPMorgan Chase & Co Chief Executive Jamie Dimon is starting to look a little more like this century's incarnation of John Pierpont Morgan.

Morgan, who established the original JP Morgan & Co in 1871, organized a rescue of the banking system in the Panic of 1907. More than 100 years later, Dimon is buying failed banks in the midst of financial chaos.

The parallel is far from perfect. Dimon's rescues are first and foremost meant to be good deals for shareholders, and not necessarily noble efforts to stabilize the financial world.

But in an era of faltering financial institutions, Dimon's JPMorgan, now the second-largest US bank by assets, seems about as strong as Morgan's did.

He acquired investment bank Bear Stearns Cos in May.

Dimon, 52, has been something of a golden child on Wall Street ever since he was a protege of Sanford "Sandy" Weill at the company that would become Citigroup Inc, JPMorgan's chief New York commercial banking rival.

Several books profiling Dimon are in the works, as his comments on Wall Street, its foibles and the US economy become more influential. This is partly because JPMorgan has avoided much of the credit mess that has embroiled competitors and left Bear Stearns hobbled, Lehman Brothers bankrupt and Merrill Lynch & Co Inc sold to Bank of America Corp.

With his latest acquisition, Dimon again took the statesman's role while snaring the deal for JPMorgan.

"He has been a good risk manager. He has been able to reap the benefits," said Rick Meckler, chief investment officer of LibertyView Capital Management.

No shrinking personality

Robert Bruner, author of "The Panic of 1907" and dean of the Darden Business School at the University of Virginia, said in July that he sees some similarities between John Pierpont Morgan's handling of the 1907 financial markets' crisis and Dimon's acquisition of Bear Stearns.

JPMorgan took over Bear Stearns after the latter suffered the equivalent of a bank run. Part of the reason JPMorgan became involved was that it was considered by the government to be the financial institution best equipped to absorb the 85-year-old company.

Dimon is known for being boisterous, opinionated and unafraid to speak his mind, even if it means talking over colleagues on calls with analysts and investors.

People who know him say Dimon cuts his peers no slack. On a conference call for Wall Street chieftains while JPMorgan was rescuing Bear Stearns, Dimon shot down a somewhat technical question from Citigroup Chief Executive Vikram Pandit, who has a doctorate in finance. According to published reports, Dimon told Pandit: "Stop being such a jerk."

Agencies

(China Daily 09/27/2008 page10)