Daiichi gets key stake in Ranbaxy

Daiichi Sankyo Co, Japan's third-largest drugmaker, agreed to buy control of India's Ranbaxy Laboratories Ltd for as much as 495 billion yen ($4.6 billion).

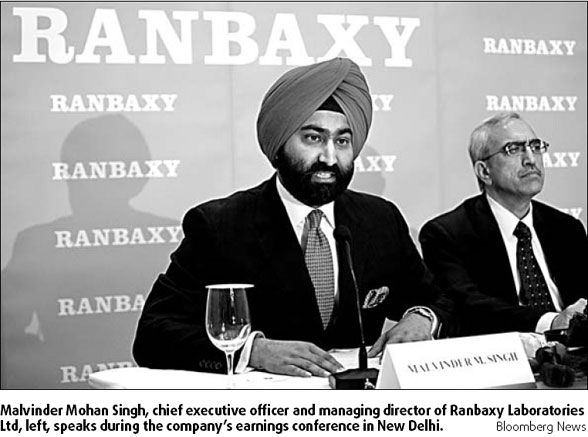

Daiichi Sankyo will acquire more than 50.1 percent of Ranbaxy, India's largest pharmaceutical company, for 737 rupees a share, 31 percent higher than its closing price on Tuesday, Daiichi said in a statement. Ranbaxy confirmed the transaction in a separate e-mailed statement.

The purchase gives Tokyo-based Daiichi a company that manufactures and sells low-cost generic drugs in 50 countries. It follows Daiichi's takeover of German biotechnology company U3 Pharma AG for 150 million euros in cash on May 21 to gain cancer treatments.

Daiichi had warned its profit would fall 18 percent this year as its main blood pressure treatments succumb to price cuts in Japan.

Its rivals in Japan, Takeda Pharmaceutical Co and Eisai Co, are also turning to overseas acquisitions to buffer sales declines as best-selling drugs lose patent protection.

Daiichi Sankyo shares rose the most in two months to 4.1 percent to 2,940 yen as of 2:30 pm on the Tokyo Stock Exchange after the Nikkei newspaper first reported the acquisition in its evening edition.

Ranbaxy has purchased seven companies in the past two and a half years, including Romania's Terapia SA.

The company has been built over the past three decades by copying blockbuster drugs such as Merck & Co's Zocor cholesterol treatment drug and selling them for a fraction of the price in countries including France, Germany and the US.

Ranbaxy aims for sales of $5 billion by 2012 and said it wants to be among the top five generic drugmakers in the US, the world's biggest drugmarket.

The company was founded in 1961, had sales of 66.35 billion rupees ($1.54 billion) in the year ended Dec 31. It reported a profit of 7.9 billion rupees.

Agencies

(China Daily 06/12/2008 page16)