Expectation of index futures launch ups stocks

Shanghai stocks rose sharply yesterday, led by a late surge in brokerages and banks, on speculation that authorities might soon announce the long-delayed launch of stock index futures.

Fan Fuchun, vice-chairman of the China Securities Regulatory Commission, told reporters at a derivatives industry conference that preparations to launch the futures were proceeding smoothly and that authorities were "basically ready".

Some speculative investors took Fan's comments as an indication regulators were prepared to take further action to support stock prices and prevent any steep fall of the market, analysts said.

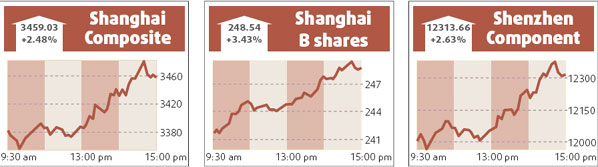

The benchmark Shanghai Composite Index rose as much as 3.29 percent to a high of 3486.332 points, before closing up 2.48 percent at 3459.026.

Turnover remained thin at 68.4 billion yuan, up from Tuesday's 55 billion yuan.

Brokerages surged, because they could benefit from increased market activity due to futures trade. CITIC Securities gained 6.16 percent to 34.32 yuan.

Big banks were strong, because they will be major components of the futures index. Industrial & Commercial Bank of China was up 1.9 percent to 5.93 yuan. China Construction Bank rose 2.55 percent to 7.24 yuan.

Sichuan Changhong Electric Co rose 1.65 percent to 6.16 yuan yesterday. The company said yesterday losses due to the quake would be minor.

One employee was killed by the Sichuan quake and 12 were injured, while direct economic losses in the form of damage to assets are estimated to total 149 million yuan.

Production lines for goods, including air conditioners and cell phones, have basically returned to normal operation, and the company is completing remaining repairs on buildings and machinery, it said.

HSI drops

Hong Kong stocks slipped yesterday, tracking soft regional markets, with investors cautious amid economic uncertainty in China and ahead of US durable goods data released later in the day.

A pull-back in global crude prices boosted shares in airlines and oil refiners, but weighed on oil producers, such as CNOOC.

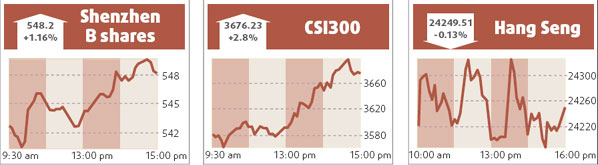

Hong Kong's benchmark Hang Seng Index slipped 0.13 percent to 24249.51, led by a 5.08 percent slide in oil and gas producer CNOOC.

The China Enterprises Index of Hong Kong-listed mainland companies, or H shares, rose 0.34 percent to 13374.74.

Mainboard turnover rose to HK$60.21 billion from HK$54.49 billion on Tuesday.

Agencies

(China Daily 05/29/2008 page15)