Market dips after rumors discounted

Shanghai key stock index dropped 1.65 percent yesterday with PetroChina, the most heavily weighted stock, sliding as the market discounted rumors of a possible fuel price hike while other large caps were sluggish.

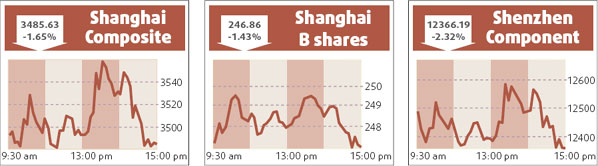

The benchmark Shanghai Composite Index ended at 3485.63, after falling to as low as 3469.792.

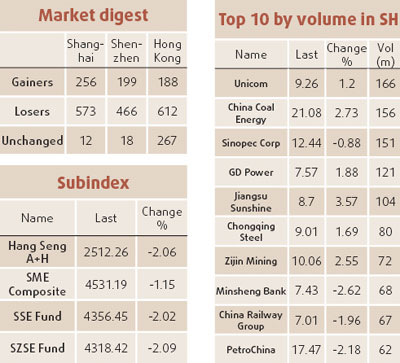

Turnover in Shanghai A shares was active at 93.6 billion yuan, although down from Wednesday's 96.2 billion yuan.

The index had risen 2.9 percent on Wednesday, led by a 6.6 percent jump in PetroChina on speculation that Beijing may raise State-set fuel prices or take other steps to aid oil refiners, which have been squeezed by surging crude oil prices.

But the Shanghai Securities News reported yesterday that China would not deregulate fuel prices anytime soon, because the government's priorities were curbing inflation and carrying out earthquake relief.

Analysts said worries about the economic impact of last week's devastating earthquake in Southwest China, which spurred a drop in stocks early this week, appeared to be abating.

"Concerns over economic damage from the quake have eased a little, with the media carrying several reports that the government will invest in reconstruction efforts and make sure they are successful, while investors have now begun to worry about how surging oil prices would affect the economy and global stock markets," said Li Shiming, analyst at Xiangcai Securities.

PetroChina dropped 2.18 percent to 17.47 yuan, with the further rise in crude oil prices increasing downward pressure on the shares.

Sinopec shares edged down 0.88 percent to 12.44 yuan after rising their 10 percent daily limit the previous session.

HK drop

Hong Kong stocks fell to a one-month closing low yesterday, weighed down by slides in Sinopec and PetroChina.

"Weak US stocks and Beijing's denial on an imminent deregulation of oil product prices hurt market sentiment," said Kenny Tang, associate director at Tung Tai Securities.

Property firms were also hit amid fears that the US rate-cutting cycle has ended, but a rebound in Japanese stocks helped the city's main index to recover above 25000 points.

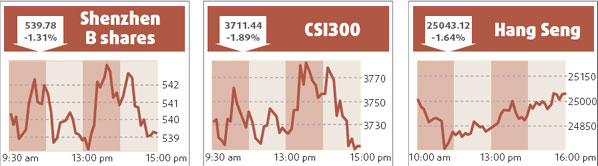

The benchmark Hang Seng Index fell 1.64 percent to close at 25043.12, well above the day's low of 24700.49. The index has dropped nearly 10 percent so far this year.

Mainboard turnover improved slightly to HK$81.1 billion from HK$79.2 billion on Wednesday.

Agencies

(China Daily 05/23/2008 page15)