Shares take a tumble with large caps

Taking its cue from the stock dive in Hong Kong, the mainland market plunged 4.48 percent yesterday, led by large caps.

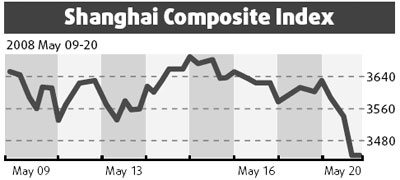

The benchmark Shanghai Composite index fell 161.60 points, the biggest in a month, to close at 3443.16. The Shenzhen Component Index plummeted 5.67 percent, or 747.78 points, to 12449.81.

The turnover on the two bourses amounted to 137.7 billion yuan, up 31.4 percent from Monday. The total capitalization was 22.5 trillion yuan.

The continuing appreciating of the US dollar against Hong Kong dollar caused a huge outflow of hot money from the Hong Kong market, analysts said. The Hang Seng Index tumbled 2.23 percent to close at 25169.46 yesterday.

"The plunge in shares of Hong Kong-listed mainland companies dragged down their A-share counterparts on the mainland," said Zhu Haibin, an analyst at Essence Securities.

Large caps fell with a thud. Shares of oil giant PetroChina tumbled 3.4 percent to close at 16.75 yuan while its H shares fell 3 percent. Industrial and Commercial Bank of China slid 2.76 percent in Hong Kong while its A shares shed 3.38 percent.

Mei Xinyu, a researcher at the Ministry of Commerce, said in his blog on May 7 that international hot money is also expected to flow out of the mainland market when returns from the currency exchange rate and capital market peak.

But Li Huiyong, an analyst at Shenyin Wanguo Securities, said: "The mainland stock market hasn't shown any large-scale hot money outflow, and the currency appreciation is still continuing."

Medicine companies took a dive in mainland trading following five straight days of gains after the earthquake. Shanghai Modern Pharmaceutical Co Ltd plunged to the daily limit to close at 9.07 yuan and Shanghai Fosun Pharmaceutical (Group) Co Ltd tumbled 7.46 percent.

"Investors are becoming more rational because the main business of many medicine companies has no relation with post-quake healthcare or with their location out of Southwest China," said Zhu of Essence Securities.

Analysts said the earthquake, combined with the blizzards earlier in the year, is expected to dampen investor sentiment about economic growth and corporate earnings.

Zhao Yuanyuan, an analyst at United Securities, said investors should not be too optimistic about the government's investments after the quake. "Past experience from other countries show natural disasters have a negative impact on growth in the short term."

(China Daily 05/21/2008 page20)