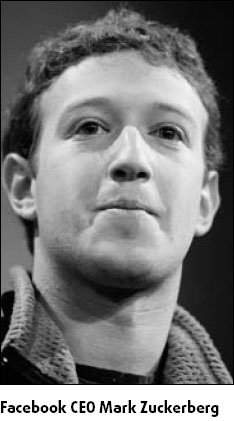

Facebook CEO stresses firm's independence

Facebook Inc founder and CEO Mark Zuckerberg reaffirmed his company's independent spirit yesterday, after a report the social networking site might be sold to software giant Microsoft, which is hunting for ways to beef up its Internet business.

"You can tell, from our history and what we've done, that we really wanted to keep the company independent, by focusing on building and focusing on the long term," Zuckerberg said while in Japan to launch a Japanese language version of Facebook.

Microsoft already has a small stake and the Wall Street Journal said this month the software giant, having failed in its $47.5 billion bid for Internet portal Yahoo Inc, had approached Facebook to gauge its interest in a full takeover.

Asked specifically about the prospect of a sale, Zuckerberg declined to comment.

Facebook, founded by Zuckerberg when he was at Harvard University in 2004, has become one of the hottest properties on the Internet because of its strong loyalty among the more than 70 million users who swap pictures, messages and virtual gifts.

Microsoft took a $240 million stake in Facebook in October last year, a purchase that valued the start-up at $15 billion.

Hong Kong tycoon Li Ka-shing recently put $120 million into the company and smaller investors have contributed another $15 million.

Zuckerberg, in the past, has resisted selling the entire company, opting to work towards an initial public offering.

Facebook is launching a Japanese website to try to lure users in Japan's online networking market, which is currently dominated by Japanese firm Mixi Inc, which has more than 10 million users and an 80 percent share of Japan's 44 billion yen ($422 million) social networking market.

Zuckerberg said he was confident that Facebook could lure Japanese users as its services differed from its rivals as users gave their real names.

"The biggest thing about Facebook is that it's real names and real people," Zuckerberg said, adding that made his site more trusted.

Agencies

(China Daily 05/20/2008 page21)