Hong Kong stock market holds steady

Hong Kong stocks held steady yesterday as fears eased over the economic impact of the devastating earthquake in Sichuan province, offsetting concerns over record high oil prices and pessimistic comments by the US Federal Reserve.

"The market simply tracked the strength of mainland stocks in the absence of fresh incentives," said Andrew To, sales director at Tai Fook Securities. "Investors mostly stayed away as the market lacked upward moving momentum."

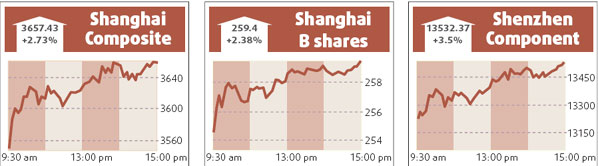

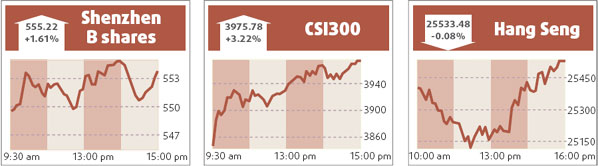

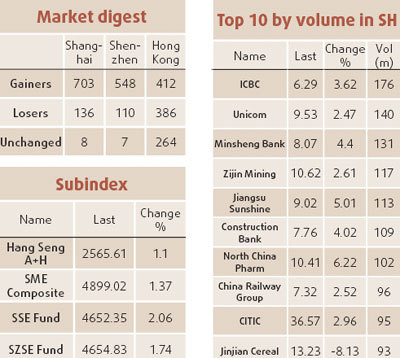

The benchmark Hang Seng Index closed down 0.08 percent, or 19.29 points, at 25533.48. The China Enterprises Index of Hong Kong-listed mainland companies, or H shares, reversed course to close up 0.02 percent at 13980.24.

Mainboard turnover fell to HK$67.92 billion from HK$80.84 billion on Tuesday.

The main index has dropped more than 8 percent so far this year. The H-share index is down more than 13 percent this year, compared with a 30 percent drop in Shanghai's benchmark stock index.

Hong Kong Exchanges and Clearing Ltd fell 1.69 percent even after it posted a 79 percent jump in first-quarter earnings on higher turnover due to sustained investor interest in China's booming economy.

Some banking stocks came under pressure, with shares of HSBC down 0.15 percent at HK$135.3 after Federal Reserve chief Ben Bernanke said financial markets were still troubled.

Insurer China Life, which had dropped as much as 3 percent, pared losses to close down 0.5 percent at HK$33.05 after its Shanghai-listed shares rebounded 2.2 percent from the previous session.

Brokers said oil refiners, already squeezed by record high oil prices, also fell on expectations they might have to raise production to meet demand after the disaster.

Asia's top oil refiner, Sinopec, lost 2.22 percent to HK$7.49 and China's second-largest oil refiner, PetroChina, dropped 0.55 percent.

Anhui Conch Cement rose 3.04 percent after China's top cement maker said it planned to raise up to 11.5 billion yuan by issuing A shares in Shanghai for expansion of cement and clinker production lines.

Shaw Brothers and its 26 percent-owned broadcaster TVB both soared about 11 percent before the stocks were suspended in the afternoon. Basis Point reported that a foreign private equity fund and a private buyer from China were rumored to be interested in own in a stake in TVB.

Agencies

(China Daily 05/15/2008 page15)