Market shaken but not stirred by quake

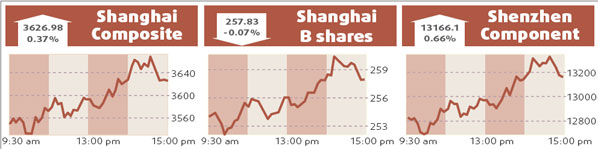

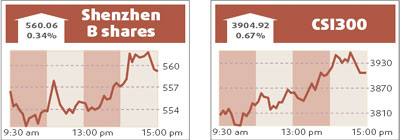

Shanghai stocks ended 0.37 percent higher yesterday, giving up some of their late gains after a strong earthquake in Southwest China rocked buildings in Shanghai about half an hour before the market closed.

The quake led to the evacuation of several highrises in Shanghai's financial district, disrupting trade, although the exchange said the market was functioning normally until its regular close at 3 pm.

"The quake made investors panic. Most of them have not yet figured out what has happened, including what losses the quake may cause," said Qiang Xiangjing, analyst at CITIC-Kington Securities.

The benchmark Shanghai Composite Index ended up 13.488 points at 3626.982 points. The index hit its intraday high of 3668.857 around the time the earthquake hit.

The index had fallen more than 2 percent in the morning after the government announced a rise in annual inflation in April to 8.5 percent, heightening fears of further government measures to cool the economy.

Turnover in Shanghai A shares was active at 116.4 billion yuan, compared with Friday's 128.5 billion yuan.

Financial shares were mixed with Industrial and Commercial Bank of China rising 0.33 percent to 6.16 yuan.

Property developers, which are most vulnerable to monetary tightening, declined. Vanke, China's largest listed developer, slipped 1.55 percent to 21.54 yuan.

Aviation shares outperformed, with Xi'an Aircraft International gaining 5.33 percent to 25.68 yuan while Hafei Aviation Industry jumped its 10 percent daily limit to 19.51 yuan.

China established a company on Sunday to build large commercial jets with an eye to eventually reducing its reliance on Boeing and Airbus, lifting aviation shares.

Baoshan Iron & Steel Co rose with other steelmakers on speculation prices for the construction material will continue to gain.

Two new shares made strong debuts on the Shenzhen bourse, with Anhui USTC IFLYTEK shooting up 140 percent from its IPO price to 30.31 yuan while Allwin Telecommunication gained 70 percent against its IPO price to 14.40 yuan.

Yunnan Metropolitan Real Estate Development surged by its 10 percent daily limit to 24.87 yuan after saying it would issue up to 132 million A shares for no less than 15.17 yuan each in a private placement with up to 10 institutional investors.

Hong Kong stock market was closed yesterday for a public holiday.

Agencies

(China Daily 05/13/2008 page15)