Withdrawal puts pressure on Ballmer

|

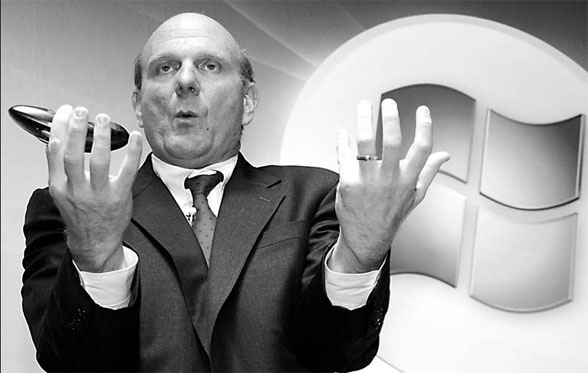

Steve Ballmer, chief executive officer of Microsoft Corp, speaks during a news conference introducing "Windows Live" in Tokyo. Bloomberg News |

Microsoft Corp's decision to drop its pursuit of Yahoo Inc increases the pressure on Chief Executive Officer Steve Ballmer to make his money-losing Internet business succeed against Google Inc.

Ballmer's bid for Yahoo, the most-visited website, signaled that Microsoft was making little progress against Google in Internet search advertising, said Charles Di Bona, a Sanford C. Bernstein analyst. Ballmer withdrew his bid over the weekend after Yahoo refused a sweetened offer of almost $50 billion in stock, leaving investors asking what his online strategy will be.

"They've got to come out sooner rather than later with a pretty well articulated vision," said New York-based Di Bona.

The danger for Microsoft is that Google, owner of the most popular Web search engine and winner of the most online advertising dollars, will expand its dominance while Ballmer plans a new course. Google gained 10 percentage points of market share in Internet queries since June, providing 59.8 percent of the searches done in March, according to researcher ComScore Inc in Reston, Virginia.

Yahoo co-founders Jerry Yang and David Filo had refused to accept less than $37 a share for the firm, sources said.

Microsoft was probably right to walk away because its return from the purchase would have been too small if it had paid more than $35, Di Bona said.

The text promotions that run next to search results account for more than half the $41 billion market for Internet ads. With Yahoo, Microsoft would have tripled its share of US online searches and would have become the biggest seller of graphical-display ads on the Internet.

Smaller acquisitions and investments in technology may not be enough to reverse the fortunes of the Internet unit, which lost $228 million last quarter.

"They're back to square one," said Chris Hickey, an analyst at London-based Atlantic Equities who recommends holding Microsoft shares.

"The fact that Microsoft wanted to do this deal shows what a difficult position they're in to start with.

"This reminded investors of Microsoft's poor market position and the long-term risk to its business from online competitors."

Agencies

(China Daily 05/06/2008 page17)