Microsoft won't budge on Yahoo bid

Yahoo Inc delivered first-quarter results that eclipsed analysts' modest expectations, but the performance did little to support the Internet pioneer's demands for software maker Microsoft Corp to raise its takeover bid above $45 billion.

The Sunnyvale-based company said that it earned $542.2 million, or 37 cents per share, more than triple its profit of $142.4 million, or 10 cents per share, at the same time last year.

The earnings were two cents above the average estimate on the same basis among analysts surveyed by Thomson Financial.

Perhaps even more importantly, Yahoo provided the same full-year revenue outlook that it made in late January - just two days before Microsoft made its unsolicited bid.

Yahoo's first-quarter revenue climbed 9 percent to $1.82 billion.

After subtracting commissions Yahoo paid its advertising partners, its revenue totaled $1.35 billion - just $30 million ahead of analysts' average projection.

Investors did not seem to be impressed as Yahoo shares shed 15 cents in extended trading after dipping a penny to finish the regular session at $28.54.

The first-quarter numbers provided a reminder of the ever-widening gap separating Yahoo from Google, whose profit during the same period climbed 30 percent to $1.3 billion on revenue that rose 42 percent to $5.2 billion.

Now it appears more likely the standoff between Yahoo and Microsoft will be resolved in a divisive battle that could drag on into the summer, opening the door for Google to grow even stronger while its two rivals are distracted by their duel.

Microsoft has threatened to oust Yahoo's board if the 10 directors do not accept the current offer on Saturday. That risky course of action, known as a proxy contest, probably would not be settled until Yahoo's shareholder meeting, which does not have to be held until July.

The cash-and-stock bid - valued at $44.6 billion, or $31 per share, when it was first made - is now worth about $43 billion, or $29.88 per share.

Without specifying a precise price, Yahoo has maintained it's worth more to Microsoft even though its shares had fallen below $20 before the bid.

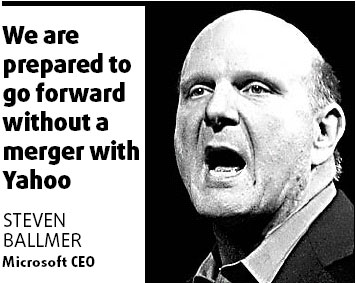

Microsoft Chief Executive Officer Steven Ballmer said the world's biggest software maker doesn't plan to raise its $44.6 billion offer for Yahoo.

'A lot of money'

"We are offering a lot of money. If Yahoo's shareholders like it, that's great," Ballmer said yesterday at a Microsoft conference in Milan. "We are prepared to go forward without a merger with Yahoo."

In an effort to catch up with Google Inc in online search and advertising, Redmond, Washington-based Microsoft made an unsolicited offer for Yahoo in January.

When asked if Microsoft might be interested in buying Google, Ballmer said the company wouldn't make an offer because it is too expensive and there would be regulatory and antitrust concerns.

Jerry Yang, Yahoo's co-founder, CEO and a board member, made it clear the company won't sell to Microsoft unless the bid is raised. "Our ability to execute on multiple fronts is clearly improving," he told analysts during a Tuesday conference call.

Yahoo expects its revenue to increase more dramatically in 2009 and 2010 as the benefits from its expanded Internet advertising network start to kick in. "We feel we are on the verge of fundamentally changing the game," Sue Decker, Yahoo's president, said in Tuesday's conference call.

An experimental advertising partnership with Google also could help boost Yahoo's profit.

Yang and Decker to declined to discuss the Google tests, which began two weeks ago. Analysts believe a long-term partnership between Yahoo and Google would be difficult to pull off because of the antitrust concerns that would raised, given the two companies control more than 80 percent of the US search market.

Yahoo also has been exploring a possible merger with the Internet operations of Time Warner Inc's AOL, which has been struggling in recent years.

"We will not enter into any transaction that doesn't recognize the full value of this company," Yang said.

Confident note

The confident tone of Yahoo's management on Tuesday contrasted with a more glum attitude in late January when Yang warned economic "headwinds" might complicate the company's turnaround efforts.

Given the Microsoft bid, Global Crown Capital analyst Martin Pyykkonen said the company's optimism should be taken with a grain of salt. "You almost have to discount anything positive management has to say because they are just trying to get the (sale) price up," he said.

Microsoft's bid conceivably could rise above its original value without management upping the ante. It might happen if Microsoft's own quarterly earnings report - due out today - pushes its shares above $32.60. Microsoft's stock price finished Tuesday at $30.25, down 17 cents.

Agencies

(China Daily 04/24/2008 page16)