Why market faces major challenges?

Though the year ahead is widely expected to be "China's most difficult year", the country's automotive market retains a torrid pace of growth. Government efforts to slow the economy and curb skyrocketing fuel prices and the rising uncertainty with the overall economy have done little to deter the enthusiasm for buying among China's newly rich consumers. This will likely change as we move forward into 2008, as the challenges faced by the market grow.

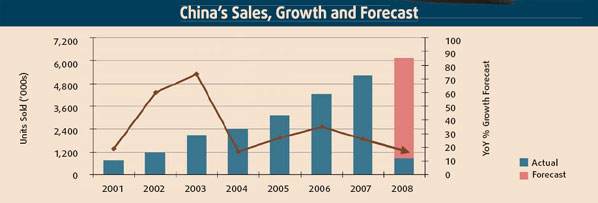

We certainly expect China's automotive market to continue to expand this year, but at a slower pace than 2007, and a slower pace than witnessed in the first few months of 2008.

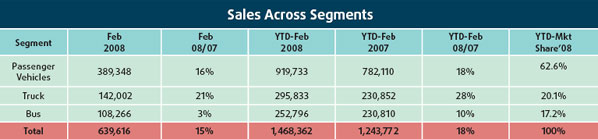

According to Meg Sunako, Chief Asia Economist at J.D. Power Forecasting, light vehicle demand expanded at a seasonally adjusted annualized rate (SAAR) of 9.5 million units in the first two months of 2008, which if sustained, would represent a 17 percent increase over the 8.1 million units delivered in 2007. The 1.46 million units sold in China during January and February represent a remarkable 22 percent increase over the 1.2 million units sold in the same period of 2007.

We believe that the market will finish the year somewhat below these early indications. We expect vehicle demand in China to grow to 9.2 million units in 2008, still an impressive 14 percent increase over 2007.

Of concern is an increasingly challenging business environment in China. Premier Wen Jiabao was quoted earlier this month as saying 2008 would be "China's most difficult year".

Among the challenges facing China is an overheating economy. China's economy grew by more than 11 percent in 2007, a pace most analysts and policymakers recognize as unsustainable and potentially destabilizing.

Inflation is a major problem in China, the number one problem according to recent comments of policymakers. Inflation through the first two months of 2008 approached a troubling rate of 9 percent.

Along with the increasing apprehension about inflation, China is - somewhat paradoxically - fearful of a slowdown in export demand in the United States. A slowdown in exports might ease inflation, but would also threaten factories and jobs along the Eastern Seaboard. Manufacturing companies there are already reporting shrinking margins as China's currency strengthens and energy and raw material costs and wages move higher.

China has taken many steps to slow its economy. It raised interest rates six times in 2007 and raised the bank reserve requirement a number of times, most recently to a striking 15 percent of deposits.

We expect the government's economic tightening policies, high inflation and the weakening export sector to begin to affect consumer demand during the course of 2008, and the rate of growth in the light vehicle market to slow in the second half from recent levels.

In the long term, we expect China's vehicle market to continue to grow as economic development continues to spread across the country. Annual light vehicle sales are expected to reach 17.3 million units by 2015, with the annual rate of growth slowing sharply to single digits as the market becomes more mature. By then, we expect the market to comprise 12.4 million passenger vehicles and 4.95 million light commercial vehicles.

In 2008, light commercial vehicles are expected to grow just slightly lower than the passenger vehicle market, 13 percent versus 14.9 percent respectively. We expect demand for light commercial vehicles to reach 3 million units this year and demand for passenger vehicles to grow to 6.2 million units.

Passenger cars will represent 5.5 million of the 6.2 million passenger vehicle demand in 2008. This total will rise to 10.9 million units by 2015, with the segment's share of PV sales remaining largely unchanged.

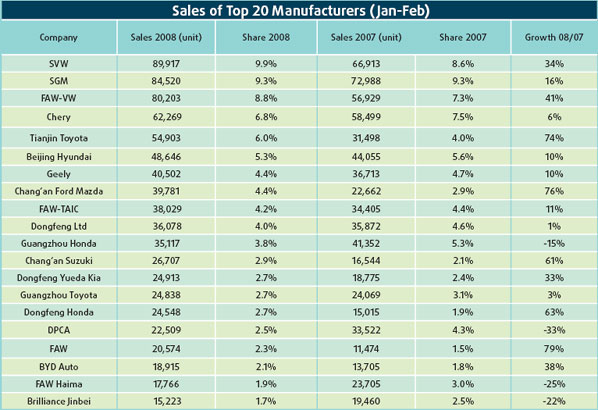

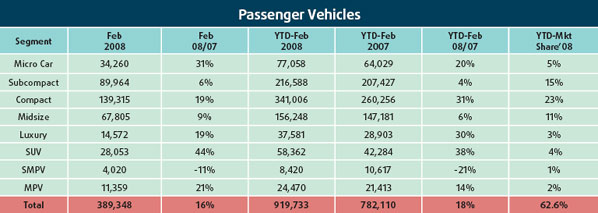

Within the passenger car segment, the compact segment enjoys the strongest growth trend. Up 36 percent in 2007 and 40 percent to date in 2008, the compact segment is proving to be the most popular and most important segment to manufacturers in China. Sales growth in 2007 was helped by several new model launches in 2006, including the new Toyota Corolla, and a strong performance by Volkswagen.

We expect this segment to come under pressure from the sub-compact segment as the price of vehicle operating costs move buyers to more fuel-efficient cars. So far in 2008, the migration to smaller cars has not happened, pointing to the important role cars play in defining car buyers' personality.

Most major manufacturers expect to succeed in the compact segment as volumes will exceed 2.2 million units in 2008.

In addition to the promise of better fuel economy, several new product offerings by manufacturers should boost sales in the sub-compact car segment. While we may be forced to reconsider our position in the face of the overwhelming strength of the compact segment, our current analysis holds that the sub-compact offers one of the best prospects for growth, with sales expected to exceed 3.2 million units by 2015.

Currently the second-largest passenger car segment with nearly 1.2 million sales in 2007, the sub-compact segment accounts for 22 percent of the passenger vehicle market.

Segment growth was comparatively slow in 2007, however, at 5.4 percent - with a number of ageing models from Hyundai-Kia, Xiali, Geely, and Suzuki slowing the segment performance. Helping to support volume growth were strong sales of the Renault Livina and the Xiali Weizhi, launched in 2007, and the Chevrolet Lova, introduced in 2006.

Growth in 2008 will be supported by expected 12 new model launches. Two new sub-compacts, the A1 and A3, will come from Chery, while Great Wall and JAC are releasing models in the first quarter.

Models from Changfeng, Toyota, Ford, Hyundai, Mazda, Peugeot, and Skoda are all also due to be released throughout 2008, among which the Ford Fiesta, Mazda2 and Toyota Yaris models are expected to perform the best.

The mid-sized car segment has grown strongly in recent years and is expected to outperform in 2008, with volumes rising by 18.6 percent to 1.13 million units. Last year's volumes rose by close to 29 percent to 957,000 units, driven mostly by the Toyota Camry and VW Passat. Honda lost ground last year, but the new Accord release this year will help it recover.

The Camry is expected to remain the clear segment leader, however. Full year sales of the VW Magotan, based on the New European Passat, will also help the segment outperform this year. The segment currently accounts for just under 18 percent passenger vehicle sales in China and this is not expected to change, with sales rising to 2.3 million units by 2015.

Growth in the mini-car market has been sluggish in comparison with other passenger car segments, with volumes rising by 4.4 percent in 2007 to 344,034 units. Mini-cars represented just 6.3 percent of the passenger vehicle market last year. Our outlook for the mini car segment is much slower growth than the overall passenger vehicle segment.

In the short term, new models will help support volumes, including the launch of Great Wall's Peri and BYD's F1 models this year. The mini car segment remains dominated by Chery with its QQ model, while Chana has been expanding aggressively since last year with its Benben model and a second model is set to follow in 2009. Haima and JAC also have new models planned for 2009.

Demand for luxury cars in China has seen explosive growth since 2004. The segment grew by just under 30 percent in 2007 to 194,000 units, after growing by 66percent in 2006.

Luxury cars will outperform the overall passenger vehicle market once again in 2008, with volume growth of 21percent to 234,000 units. Strong demand for locally produced Audi and BMW brand vehicles, and imports from Lexus will drive demand. By 2015, the luxury car segment is forecast to double in size to over 521,000 units.

China's SUV market growth picked up dramatically in 2007, with volumes rising by almost 46 percent to close to 433,000 units against 297,000 units in 2006.

Compact models accounted for 53percent of sales, or 231,000 units, with models such as the Honda CR-V and the Hyundai Tucson the leading foreign models last year with 45,707 and 44,731 sales respectively. The best-selling compact model was the Chery Tiggo, however, with over 50,000 unit sales.

The Toyota Rav4, the Chevrolet Captiva and the Kia Sportage, as well as recently launched models such as the Mitsubishi Outlander will support segment growth.

Lastly, the MPV segment is expected to grow 16percent in 2008, with new models from international brands such as Mazda and Suzuki. MPV sales hit 241,000 units in 2007, up 19percent over 2006, for a share of 4percent. The segment's growth was below par with the overall market, despite new model launches from some of China's leading domestic brands, like Chery, Foton and Haima.

MPV segment sales are expected to reach 280,000 for the full year of 2008. Growth should keep pace with increase in overall demand till 2015, at which time volumes will hit 600,000 units.

In sum, despite mounting challenges within China's business environment, the nation's automotive market will continue to grow across all segments. Expect growth to slow from its current pace, but continue to expand at a rate to make most markets envious.

John Bonnell is from Automotive Resouces Asia, a division of JD Power and Associates.

(China Daily 04/18/2008 page13)