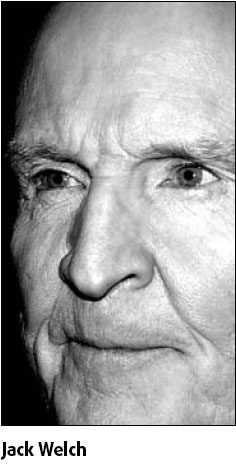

Welch threatens to 'shoot' Immelt over earnings

Former General Electric Co chief executive Jack Welch said that he would "get a gun out and shoot" his successor, Jeffrey Immelt, if he allowed GE to miss earnings targets again.

"I'd be shocked beyond belief and I'd get a gun out and shoot him if he doesn't make what he promised now," Welch said on CNBC, a cable station owned by GE. "Just deliver the earnings. Tell them you're going to grow 12 percent and deliver 12 percent."

The remark showed the depth of his ire at GE's announcement last Friday that profit fell 6 percent in the first quarter from last year. The report came a month after Immelt promised investors that the company would hit its financial goals.

"Here's the screw up: You made a promise that you'd deliver this and you missed three weeks later," Welch also said. "Jeff has a credibility issue. He's getting his a- kicked. He apologized."

GE spokesman Gary Sheffer did not directly address Welch's comments.

"We've said we hate to disappoint investors, but we're confident we have a strong set of businesses and the right strategy to execute on our revised outlook for the year," he said.

GE said that disruptions in its financial business late in the quarter kept it from warning Wall Street. But investors and analysts were stunned as stock fell 13 percent and wiped nearly $47 billion off the company's value.

Welch, 72, retired as chief executive in 2001. He strongly defended GE and said investors should not clamor for major changes because the conglomerate's business model works.

"I'm not here defending what happened," Welch said. "This was a bad miss. This is a credibility crash. He's got to earn it back. He will earn it back. But to take GE apart, what's wrong with the company, it's falling apart, blow up the model, sell NBC, sell real off estate, let's go out of business because we had 24 hours of a mess?"

On Friday, GE reported its financial services business fell 28 percent, driven by a 21 percent erosion in commercial finance due to lower real estate and other income. Net income fell 6 percent to $4.3 billion, or 43 cents per share, from $4.57 billion, or 44 cents per share, a year ago.

Earnings from continuing operations came to $4.4 billion, or 44 cents per share, down 8 percent year-over-year. That was well below the 51 cents per share expected by analysts surveyed by Thomson Financial.

Investors were shocked by the lower-than-expected earnings and a profit warning that wiped $46.9 billion off GE's value and sent the overall market slumping.

During Welch's two decades as head of the Fairfield-based company, GE expanded from a $13 billion manufacturer of appliances and light bulbs to a $480 billion conglomerate. He divested GE of billions of dollars in businesses and steered the $6.4 billion acquisition of RCA, including the NBC television network.

In retirement, he gives speeches and writes books and a "Business Week" column while continuing to draw a GE pension.

Agencies

(China Daily 04/18/2008 page16)