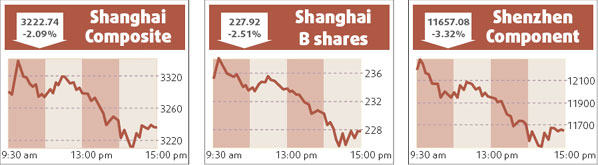

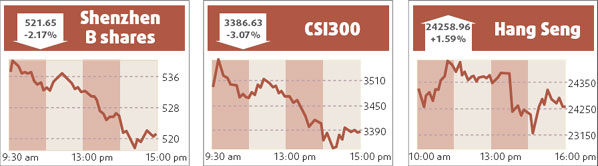

HK shares rise 1.6% on regional upswing

Hong Kong stocks tracked regional gains to rise 1.6 percent yesterday, with Chinese oil giants Sinopec and PetroChina leading the climb on speculation the government could step in to help refiners trim losses.

Upbeat US corporate earnings lifted sentiment across the board, but turnover remained low as some investors stayed on the sidelines to await more clues on the global economic outlook.

"People are still cautious as the world's credit is very tight and global investors, who have accumulated a lot of stocks in emerging markets, are eager to sell at rallies," said Andrew To, sales director at Tai Fook Securities Co Ltd.

The benchmark Hang Seng Index gained 380.61 points to finish at 24258.96, boosted by a 5.8 percent jump in Sinopec and a 3.4 percent climb in PetroChina.

Speculation that Sinopec might get some assistance from the government to help it trim losses at its refinery business amid record oil prices fuelled the stock rally, brokers said.

But record high prices should benefit upstream operators, such as CNOOC, which rose 3 percent.

The China Enterprises Index of Hong Kong-listed mainland companies, or H shares, climbed 2.3 percent to close at 12887.76.

Mainboard turnover stood at HK$72.66 billion, up from HK$64.63 billion on Wednesday.

Property firms climbed, with China Overseas rising 3.6 percent and Hang Lung Property up 2.6 percent.

More earnings from financial firms, such as Merrill Lynch and Citigroup, this week should give the market better trading clues.

The latest market rebound could take the Hang Seng Index to the 26000 level before a correction in August or September, if the banks release better-than-expected results, said Ernie Hon, strategist at ICEA Securities.

Huaneng Power International, China's largest independent electricity provider, bucked the positive trend to fall 0.6 percent.

Citigroup cut Huaneng to "sell" from "buy" after the company said its first-quarter net profit fell more than 50 percent due to rising coal costs. "The aviation sector is dead as oil prices rose to records and Chinese power companies are facing rising costs," To said.

"There is no real good news, and very few sectors are worth buying," he added.

Shares in power equipment conglomerate Shanghai Electric slid 6.6 percent and Datang Power fell 1.8 percent.

Agencies

(China Daily 04/18/2008 page15)