Shanghai index pitches, then picks up

Shanghai's main stock index sank to a fresh 12-month low in early trade yesterday, dragged down by property shares, but a rebound in the mining and non-ferrous metals sectors helped the market close higher.

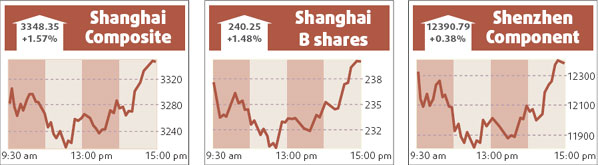

The benchmark Shanghai Composite Index hit an intra-day low of 3212.15 points but bounced in the final 40 minutes of trade to close 1.57 percent higher at 3348.353.

The fact that the market did not close below its April 3 low of 3271.29 was positive technically, since analysts hope at least a medium-term bottom is forming in that area.

But turnover remained thin yesterday, showing many disappointed investors were staying out of the market, and analysts said it was unclear if any kind of extended rebound was starting.

Turnover in Shanghai A shares shrank to 58.8 billion yuan from Monday's 66.6 billion yuan.

Western Mining shot up 6.09 percent to 23.85 yuan in what some traders said might be a response to the setting of a fairly strong price range for Zijin Mining's Shanghai IPO.

Property shares plunged in early trade but later recovered most of their losses. Poly Real Estate Group, which said first-quarter net profit soared 230 percent, was down its 10 percent daily limit at one stage but ended 4.16 percent lower at 23.29 yuan.

Real estate developers have been hurt this week by rumors that authorities might take fresh action to curb rises in real estate prices.

"The market's rise yesterday is just a corrective rebound. People are still arguing over whether the bear market has further to go," said Xu Guangfu, analyst at Xiangcai Securities.

HK market steady

Hong Kong shares held steady yesterday, biding their time on the eve of the release of mainland's economic data, but investors flocked to bargains and defensive plays, such as resources and utilities, and sent chipmaker SMIC soaring nearly 50 percent.

Fears that the central government would revive measures to slow the economy and curb inflation kept investors on the sidelines. They were also awaiting earnings by major US firms, such as Intel Corp.

Some brokers argued the market had digested the potential negative fallout of the mainland's fresh macroeconomic curbs.

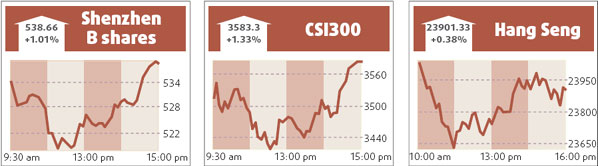

The benchmark Hang Seng Index crept 0.4 percent higher to end at 23901.33. The China Enterprises Index of Hong Kong-listed companies, or H shares, finished flat.

Mainboard turnover dwindled to HK$71.45 billion versus HK$74.8 billion on Monday.

Agencies

(China Daily 04/16/2008 page15)