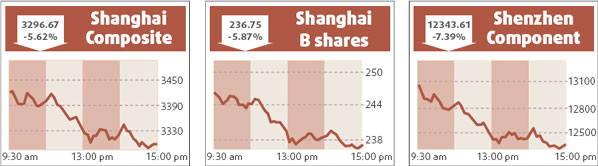

Hong Kong market slips with mainland's

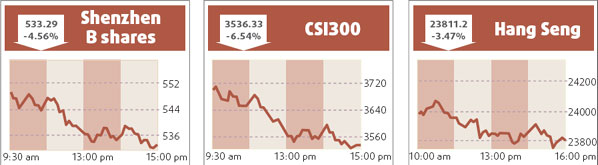

Hong Kong shares tracked mainland losses to fall 3.5 percent yesterday, as banking stocks led a sell-off on resurgent fears that strong economic data could trigger a new round of austerity measures.

The red chip companies also came sharply into focus after a newspaper reported Beijing was discouraging them from listing shares in Shanghai because of weak sentiment on domestic bourses.

"All eyes are now on the data due from the mainland this week, not to mention earnings from some major US firms," said Ben Kwong, chief operating officer from KGI Asia. "It's no surprise there was a correction after recent gains. That's no disappointment."

The blue-chip Hang Seng Index may head for the 23000 level if the index fails to hold above a floor of 23400, Kwong added.

The benchmark Hang Seng Index ended at 23811.2 yesterday, weighed down by a near-6 percent dive in China Construction Bank. The China Enterprises Index of Hong Kong-listed companies, or H shares, slid 5.2 percent.

Mainboard turnover dipped to HK$74.8 billion from HK$77.14 billion on Friday.

Concern over potential measures to curb inflation after the release of mainland consumer price and first-quarter GDP data this week weighed on the market.

The financial stocks slid, taking the financial sub-index 3.6 percent lower. ICBC fell 5.9 percent and China Life slid 5.8 percent.

Shares of China Construction Bank fell to HK$6.32 after the lender said it will issue up to 40 billion yuan in subordinated bonds with maturity of not less than 10 years.

Stocks were also weighed down after the South China Morning Post quoted sources familiar with the plan as saying no red chips, including China Mobile, CNOOC, Lenovo or China Netcom, were likely to be allowed to list A shares in Shanghai this year.

China Mobile fell 3.7 percent, CNOOC dropped 4.8 percent, Lenovo slid 2.6 percent and China Netcom lost 4.6 percent.

Shares of BYD Co fell 6.5 percent to HK$12.06. The Chinese mobile phone battery maker said on Friday its operations or financial status would not be affected by the detention of its former vice-president Xia Zuoquan, for questioning over an ongoing investigation. He was released on Mar 24 on lack of evidence.

Sino Union Petroleum Chemical International bucked a weak market to surge 8.1 percent to HK$1.61. It said it planned to form a venture with Yanchang Petroleum to explore for oil and gas abroad, with an investment of up to $300 million.

Agencies

(China Daily 04/15/2008 page15)