Financials lead rally but turnover thin

Shanghai's stock market rose yesterday, led by financials, after the biggest bank and the largest listed brokerage said they would report good first-quarter earnings.

But turnover was tiny and analysts said the market's outlook remained murky following a tumble on Wednesday as IPO subscriptions drained liquidity.

"It is hard to say if the index is finding its real bottom. Poor turnover suggests investors are still scared of steep falls, and think any rebounds may be short-lived," said Li Wenhui, an analyst at Huatai Securities.

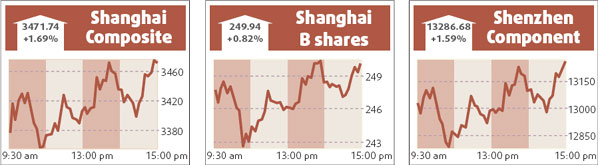

The Shanghai Composite Index, which sank 5.5 percent on Wednesday, closed 1.69 percent higher yesterday at 3471.743 points, bouncing from an early low of 3344.87.

Turnover in Shanghai A shares shrank to a seven-week low of 59.4 billion yuan from Wednesday's 80.9 billion yuan.

Late on Wednesday, the Industrial and Commercial Bank of China estimated its net profit in the first quarter of this year rose at least 50 percent.

Meanwhile, CITIC Securities estimated first-quarter profit more than doubled. That marked a slowdown from last year's fivefold growth, but it was still better than many investors had expected.

The earnings announcements partially eased concern about slowing Chinese corporate profit growth, boosting ICBC shares by 2.83 percent to 6.18 yuan. China Construction Bank rose 1.98 percent to 7.22 yuan.

CITIC Securities was suspended for a shareholder meeting, but brokerage shares outperformed, led by Haitong Securities. It shot up 9.98 percent to 35.83 yuan after reporting 2007 profit rose elevenfold, though first-quarter growth slowed to 26 percent.

But analysts said the financial companies' earnings announcements hadn't completely removed concern about the impact of an expected slowdown of the economy later this year, so the market appeared unlikely to stage an extended rebound.

'Caution will prevail'

Hong Kong's blue chips climbed yesterday as financial stocks gained, but experts say caution will prevail in coming weeks amid persistent concerns of a global economic downturn.

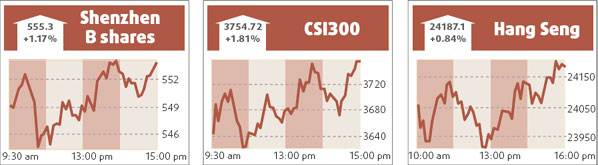

The benchmark Hang Seng Index rose 0.84 percent to 24187.10. The China Enterprises Index of Hong Kong-listed mainland companies, or H shares, gained 1.04 percent to 12998.21, just shy of the 13000 level.

Mainboard turnover fell to HK$74.81 billion from HK$83.41 billion, a trend analysts see continuing.

Agencies

(China Daily 04/11/2008 page15)