Index edges up on brokerage, base metal stocks

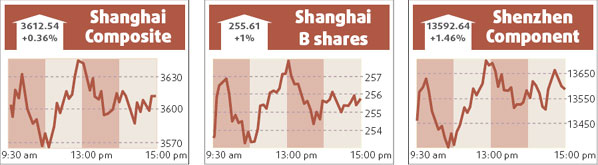

Shanghai's main stock index gave up most of the day's gains to close modestly higher yesterday, retreating from near its 20-day average, which some analysts consider important technical resistance.

Boosted by surging shares in brokerages and base metal producers, the Shanghai Composite Index rose as much as 1.59 percent just after midday to a high of 3656.961 points, extending Monday's 4.45 percent jump.

But the index lost steam as it neared the 20-day average and it ended just 0.36 percent higher at 3612.539.

Turnover in Shanghai A shares climbed to a two-week high of 92.4 billion yuan from Monday's 84.3 billion, it remained below the levels of 100 billion yuan or more that some traders think necessary for an extended market rebound.

Some analysts said yesterday's rising turnover - as well as the buying of brokerage shares, which are very sensitive to market conditions - showed the market had finally bottomed for the medium term at least.

"The floor for the medium term has been confirmed, since profit-taking has not ruined the rebound and the market has climbed for three straight trading days," said Zhang Yanbing, an analyst at Zheshang Securities.

Sinolink Securities shot up its 10 percent daily limit for a third day in a row, to 29.71 yuan, in its heaviest trade for over a year.

CITIC Securities, the biggest listed brokerage, rose as much as 6.74 percent during the day in its heaviest trade for over two years, but ended up just 1.46 percent at 57.68 yuan.

Base metal producers outperformed for a second day, led by Aluminium Corp of China, which gained 1.36 percent to 23.17 yuan after rising 10 percent on Monday.

But some analysts remained cautious about the market's outlook, noting that the extent of China's expected economic slowdown this year was not yet known, and it was unclear if inflation was peaking.

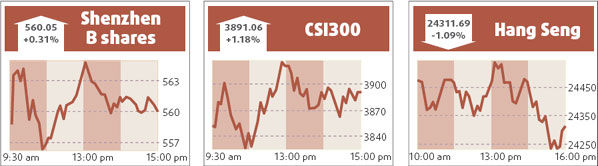

HK sheds 1.09%

Hong Kong stocks fell 1.09 percent yesterday, tracking losses in regional markets, with financial shares such as HSBC Holdings leading the drop as investors locked in profits a day after the index hit a five-week closing high.

The benchmark Hang Seng Index ended down 267.07 points at 24311.69. It has fallen 24 percent since it hit an all-time high in October.

The China Enterprises Index of Hong Kong-listed mainland firms, or H shares, fell 1.67 percent to 13196.22.

Mainboard turnover fell to HK$87.74 billion, from HK$99.47 billion on Monday.

Agencies

(China Daily 04/09/2008 page15)