Economic growth worries hold back key index

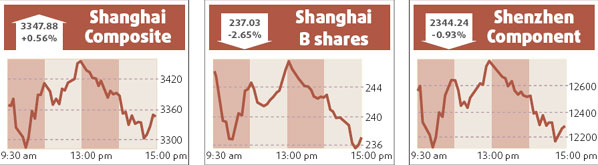

Shanghai's main stock index came sharply off the day's highs yesterday to close slightly higher, underperforming foreign markets because of concern about slowing economic growth and huge supplies of fresh equity.

Although heavily weighted financials supported the index, possibly because institutional investors now saw the valuations of some of them as attractive, the vast majority of shares fell.

The benchmark Shanghai Composite Index surged as much as 4.07 percent at one stage in response to the strength of overseas markets and an expression of support for the market by the Cabinet.

But the index retreated in the late afternoon to finish at 3347.882 points, up just 0.56 percent from Tuesday's 11-month closing low.

Turnover in Shanghai A shares remained moderate at 86.2 billion yuan, though it was up from Tuesday's 72.8 billion yuan.

Overseas markets were encouraged by strong demand for a Lehman Brothers share offer, which fueled hopes that the worst of the US credit crisis might be past.

But analysts noted that some of the factors hurting the Shanghai and Shenzhen markets, such as a supply/demand imbalance, were domestic rather than international.

"It will take time for market confidence to heal. The index may still go down further," said Gu Lingyun, fund manager at Orient Securities.

The market's biggest stock, PetroChina, ended 1.96 percent higher at 17.16 yuan after hitting a high of 17.5 yuan. Early in the morning it again slipped to 16.7 yuan, the price of the company's Shanghai initial public offer last October, and again managed to avoid breaking below that level.

Many traders believe large institutions may be deliberately supporting PetroChina's shares at the IPO price, as any break could trigger further panic.

HK gains 3%

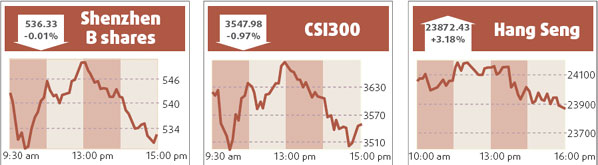

Hong Kong stocks surged yesterday, tracking strong gains across Asia.

The benchmark Hang Seng Index leapt as much as 4.6 percent in morning trade, but retreated on profit-taking to end 3.18 percent higher at 23872.43 points, buoyed by property and financial plays.

Heavyweight HSBC gained nearly 2 percent, lifting the market over 70 points.

The China Enterprises Index of Hong Kong-listed mainland companies, or H shares, closed up 4.66 percent at 12807.35.

Analysts said the rebound came after subprime gloom eased and shares recovered from first-quarter lows, but profit-taking loomed.

Agencies

(China Daily 04/03/2008 page15)