Fed gets greater powers

|

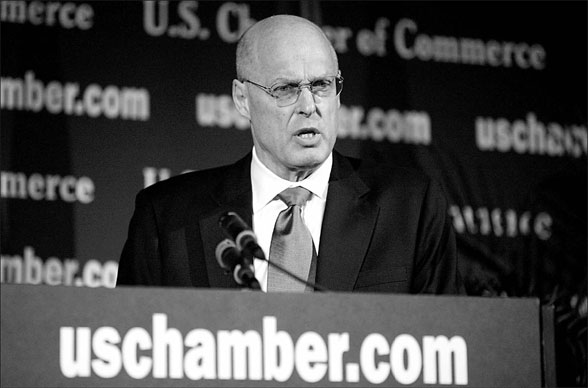

US Treasury Secretary Henry Paulson speaks at the second annual Capital Markets Summit in Washington. Bloomberg News |

Treasury Secretary Henry Paulson yesterday revealed sweeping new plans for streamlining a hodgepodge of regulation faulted for permitting the US mortgage crisis to balloon into a full-blown economic threat.

The regulatory blueprint proposes vesting new powers as a "market stability regulator" in the Federal Reserve - effectively formalizing a role it already has been performing by providing liquidity to investment banks and lowering official interest rates.

It would give the US central bank authority to demand that all financial system participants supply it with full information on their activities and grant the Fed a right to collaborate with other regulators in setting rules for their behavior.

Since problems surfaced last August with rising failure rates on subprime mortgage loans to less credit-worthy borrowers, credit markets have come near seizure several times. And public anger has mounted at what was perceived as slack enforcement of existing rules.

Many mortgage loans were made without basic fact-checking. Some did not even verify whether borrowers actually earned the incomes they claimed or whether they were steered into inappropriate loans with low initial "teaser" rates that soon reset at higher rates requiring much larger monthly payments.

The Treasury acknowledged that the current regulatory system is full of "regulatory gaps as well as redundancies". It sets out an ambitious schedule for modifying and simplifying it - one that has little chance of being enacted in President George W. Bush's remaining 10 months.

Among changes, the Treasury wants to merge the Securities and Exchange Commission, the US markets watchdog, with the Commodity Futures Trading Commission that is charged with overseeing the activities of the nation's futures market.

It also recommends getting rid of a Depression-era charter for thrifts that was intended to make it easier to obtain mortgage loans, saying it is no longer necessary. That would mean closing the Office of Thrift Supervision and transferring its duties to the Office of the Comptroller of the Currency that oversees national banks.

In one important change to try to clamp down on mortgage brokers, the Treasury is urging the establishment of a "Mortgage Origination Commission" made up of regulatory agency representatives that would be able to set licensing standards for mortgage brokers.

That would boost consumer protection by increasing scrutiny of the personal conduct, disciplinary history and educational qualifications of the people who are frequently on the lending front lines.

Paulson, a 30-year veteran of Wall Street who initiated the regulatory study a year ago, has warned against dampening "innovation" by applying too many rules to the financial services sector and his stance will raise questions.

Paulson said it was neither "fair or accurate" to blame lax regulation for the current turmoil.

Agencies

(China Daily 04/01/2008 page16)