Pacific Insurance drops below IPO price

Shanghai stock market ended lower yesterday as China Pacific Insurance became the first major share to fall substantially below its IPO price since a suspension of IPOs was lifted in mid-2006.

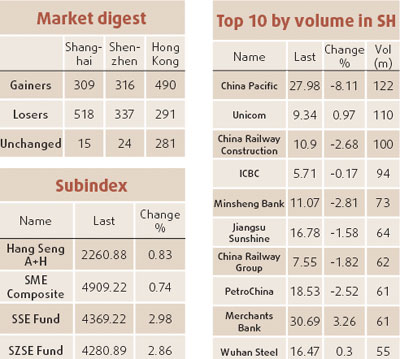

Pacific Insurance, the most heavily traded stock, tumbled 8.11 percent to close at 27.98 yuan after setting a record low of 27.6 yuan, dropping below the 30 yuan price of its Shanghai IPO last December.

Brokers said institutions which bought Pacific Insurance during the IPO were apparently scrambling to avoid losses. A total of 300 million shares related to the IPO became freely tradable yesterday after a lock-in period expired.

The selling in Pacific Insurance was a negative sign for the overall market, because it suggested institutional holders of other major stocks might be willing to sell them down below their IPO prices as well, analysts said.

"The massive selling of Pacific Insurance suggests investors' confidence in the future is very fragile," said Qian Xiangjing, analyst at CITIC-Kington Securities.

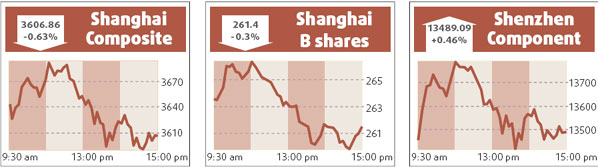

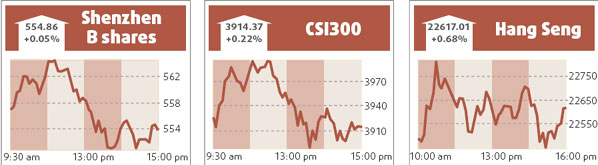

The benchmark Shanghai Composite Index gave up early gains to end down 0.63 percent at a fresh 11-month closing low of 3606.857 points, off an intra-day low of 3591.108. It is now down 41 percent from October's record peak.

Turnover in Shanghai A shares shrank to a thin 70.3 billion yuan from Tuesday's 77.6 billion.

The most heavily weighted stock, PetroChina, which has been weak since it posted disappointing 2007 results last week, closed down 2.52 percent at 18.53 yuan after setting a fresh record intra-day low of 18.5 yuan. It dropped 4.14 percent on Tuesday.

HK stocks edge up

Hong Kong stocks ended modestly higher in sluggish trade, buoyed by strong results from blue-chip financial firms, but the upside was capped as investors remained cautious about the market's outlook.

Snack maker Want Want China Holdings Ltd made a lackluster market debut as its shares slid to HK$2.92, below the initial public offer price of HK$3, after the firm raised $1 billion in its Hong Kong IPO.

The benchmark Hang Seng Index ended 0.68 percent higher at 22617.01 points. The China Enterprises Index of Hong Kong-listed mainland companies, or H shares, finished up 1.14 percent at 11860.22.

Mainboard turnover fell to HK$89.91 billion from HK$100.6 billion on Tuesday.

Agencies

(China Daily 03/27/2008 page15)