Steelmaker branches out to cover all bases

While many Chinese entrepreneurs look to top foreign companies for guidance, Huang Tianwen couldn't find the right business on which to model his company.

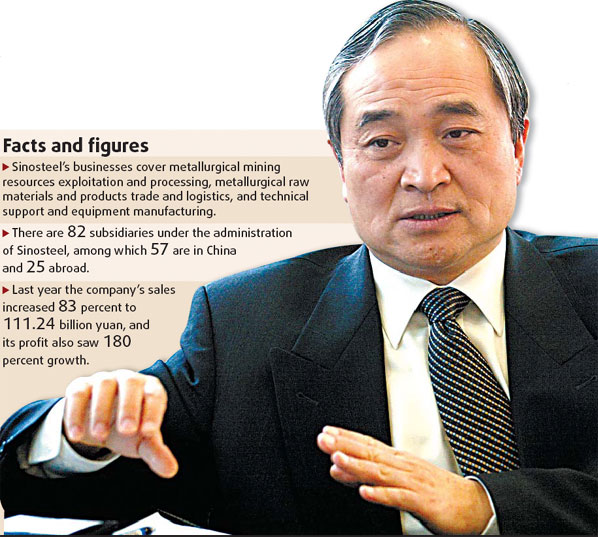

Huang's been president of State-owned Sinosteel Corp since 2003. In that time, he's helped the company transform from iron ore trader to an integrated steel industry services provider.

Formed in 1993, Sinosteel's businesses now cover metallurgical mining resources exploitation and processing, metallurgical raw materials and products trade and logistics, technical support and equipment manufacturing.

"We provide full services to steel companies, both in upstream and downstream sectors," Huang said.

"As the world's largest steel manufacturer, China has many big steel companies. But in the service sector, no other company in the country can provide the full range of services we do.

"Globally, I don't know of any big company that covers the business range Sinosteel does."

Sinosteel's restructure has brought the company great success. Its 2007 sales increased 83 percent to 111.24 billion yuan and its profit also saw 180 percent growth last year.

"Now we are preparing for an IPO," Huang said. "We will reinforce our resources development, trade and logistics, engineering, science and technology."

Huang said the company is focusing on boosting manufacturing facilities like raw material and equipment production to increase service capacity.

Last year, the company took over Jilin Ferroalloy Co Ltd, China's largest ferroalloy producer. That deal boosted Sinosteel's ferroalloy manufacturing capacity. Now it's become one of the world's major ferroalloy producers.

China's ferroalloy industry is likely to see more consolidation in the next few years and Sinosteel plans to use this to its advantage, Huang said.

Sinosteel signed four important deals in 2006. Its machinery equipment manufacturing business was bolstered when it took over Jilin Xinye Equipment Co Ltd, Xingtai Mechanical Roll Co Ltd and Hengyang Nonferrous Metallurgical Machinery Co. Meanwhile, Sinosteel's raw material production capacity was boosted by its takeover of Jilin Carbon Co Ltd.

"By enhancing our manufacturing capacity, we can provide better service to our customers. We will continue to look for further investment opportunities in this area," Huang said.

Sinosteel has also formed close ties with big domestic steelmakers. Last year, it signed a deal with China's largest steelmaker Baosteel for the two companies to boost cooperation on the supply of iron ore and chrome ore, ferroalloy and mining equipment.

Huang expects more consolidations ahead in the domestic steel industry, with the bigger players likely to dominate the market. He said Sinosteel's relationship with the industry majors puts it in a good position.

Sinosteel was one of the first Chinese companies to do business overseas. Huang said the steel company plans to ramp up its overseas activities, including developing mining resources in countries like Australia, India and South Africa.

It already has 21 subsidiaries and two representative offices operating overseas and has established itself in the Southeast Asian, Australian, African, European and South Asian markets.

Headquartered in New Delhi, Sinosteel's Indian subsidiary is the first solely owned China-funded company approved by the Chinese and Indian governments.

Sinosteel India has three branches - in Kolkata, Goa and Hospet. Its main activities involve developing metallurgical mineral resources, trading and logistics, engineering technology services, equipment manufacturing and industrial investment projects.

Mining resources development is Sinosteel's main overseas business focus. The company's Channar iron ore manufacturing project is the largest industrial project between China and Australia.

The project has been operating successfully for 17 years and has produced a total 150 million tons of iron ore. All of its products have been sold to the Chinese market.

In South Africa, Sinosteel's 50-50 joint venture with Samancor, one of the world's largest chrome ore owners, can turn out 1 million tons of chrome ore and 310,000 tons of ferrochrome annually.

Huang sees it as a win-win venture. Samancor has rich chrome ore resources and Sinosteel has the advantage in technology, marketing, management and fundraising.

"We have adopted many global standards in our business, which will make our company more multinational," Huang said.

"Our overseas projects also help local economic development. For instance, they help to increase local government tax revenue and open up many job opportunities."

(China Daily 03/25/2008 page15)