Stocks claw back 1.13% in volatile trading

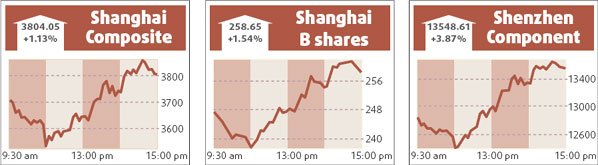

The mainland stock market gained another 1.13 percent in volatile trading yesterday, after Wednesday's rebound.

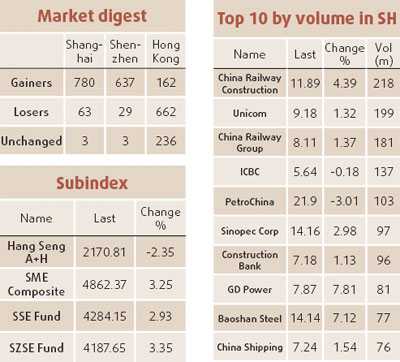

The benchmark Shanghai Composite Index plunged 6.5 percent in the morning to 3516 points, led by PetroChina. But it rebounded in the afternoon to close at 3804.05, up 42.44 points from the day before.

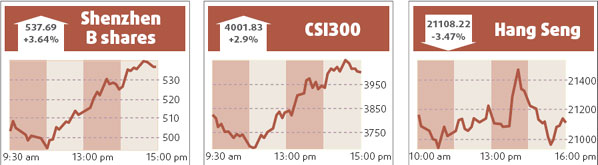

The Shenzhen Component Index jumped 3.87 percent, or 504.41 points, to close at 13548.61. Turnover on the two bourses amounted to 156.3 billion yuan, up 18.4 percent from Wednesday.

Analysts said bargain investors began entering the market when the index dropped to 3500 points, a key psychological barrier.

Rumors that a stamp tax cut has been approved also raised investor expectations that the government will support the market.

"The 3500-level is appealing for many institutional investors wanting to buy up financial and real estate stocks," Wu Feng, an analyst at TX Investment Consulting Co Ltd, said.

"The recent move to approve new QFII funds recently also boosted investor expectations for the government to open the door wider to qualified foreign institutional investors," Wu said.

China's largest real estate developer Vanke A surged 5.96 percent to close at 24.96 yuan, while Shanghai Pudong Development Bank soared 6.51 percent to close at 34.7 yuan.

But PetroChina, China's largest company by total capitalization, tumbled 3.01 percent after it posted a 1.21 percent drop in net profit for 2007.

Steelmakers led the rally after China's largest, Baosteel, said it will raise the steel price in May. Other steel producers are expected to follow suit.

Stocks in the non-ferrous sector continued to slide due to falling non-ferrous metal prices on the global market. Copper futures prices have plunged 11 percent in the past two weeks to $7,835 per ton yesterday. Yunnan Aluminum fell 3.94 percent to close at 36.1 yuan.

A central bank survey released yesterday shows investor sentiment is still low. Only 27.6 percent of investors said they would invest in equity and mutual funds, down from 44.3 percent in the third quarter last year.

Families with equities as their main assets fell from a high of 12.8 percent in the third quarter last year to 10.4 percent in February, the survey found.

(China Daily 03/21/2008 page15)