Funds in flux but big yields still elusive

Qualified domestic institutional investor (QDII) funds are fluctuating after plummeting at the end of last year, but analysts said more geographic and portfolio diversity is needed.

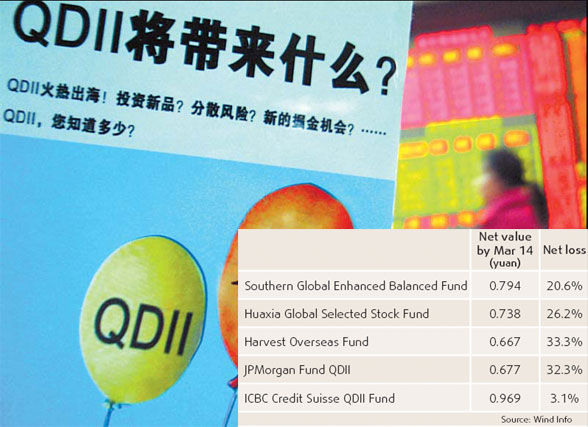

The first batch of QDII products - Southern Global Enhanced Balanced Fund, Huaxia Global Selected Stock Fund, Harvest Overseas Fund and JPMorgan Fund QDII - got a warm investor response when they were released in September last year. Most were oversubscribed on the first day of issue.

But the initial burst of enthusiasm didn't last. By Jan 11, the net value of all four stock-oriented QDII funds had fallen below 1 yuan - the value set for fund subscriptions - with total losses of 14.43 billion yuan.

Meanwhile, the latest QDII product received a lukewarm response from investors. ICBC Credit Suisse Asset Management Ltd had planned to collect 22 billion yuan under the QDII scheme, but only got 3.15 billion yuan after a subscription period of nearly a month.

The sixth QDII fund is to be issued by Fortune SGAM Fund Management Co Ltd on March 24. Can it warm the market or meet the same lukewarm embarrassment?

"The market is still too choppy to predict a V- or W-shape, as the effects of the US subprime crisis will be gradually unveiled and there's still many uncertainties," Ding Zhijie, associate dean at the University of International Business and Economics' finance school, said.

The first round of funds made a collective rebound for three days at the end of February, but the fund's net values are still under 1 yuan and they fell again recently, according to mainland data provider Wind Info.

Industry analysts said the world economic direction will be clearer when the US reveals its first-quarter macroeconomic data.

"The second quarter may be a good time to invest in Hshares, as stock values will have dropped to a reasonable level and most uncertainties will be wiped out at that time," Jing Ulrich, chairman of China Equities at JPMorgan, said.

Industry analysts agree that QDII funds will likely see an annual yield of around 10 percent this year.

"Given the appreciation pressure on the Chinese currency and the US subprime crisis, the estimated annual yield of QDII products in 2008 may be below 10 percent," Ding said.

In the US, Europe and other mature capital markets, QDII-type funds are evaluated positively if annual yields reach 15 percent. Given that China is an emerging market, the ambitious QDII annual target is 15 to 25 percent, Song Lu, an analyst at China Construction Bank, said.

Industry analysts also stressed that QDII products are a long-term investment tool and should be evaluated after a year or over a longer period.

"We should look at how fund companies are evaluated in mature capital markets overseas, where the evaluation period can be five years, three years - but one year at least," Zhao Xijun, associate dean of Renmin University of China's finance and securities institute, said.

Dong Chen, a senior analyst at China CITIC Securities, said it's not possible for China to jump from emerging to mature market in one step.

"The learning process may last two to three years and QDII products will be more mature at that time," Dong said.

The government has so far opened the door for mainland commercial banks to invest in Hong Kong, the UK, Singapore and Japan. The US and Germany are next.

While enthusiasm for the funds is waning among local investors, some are taking a punt on the long-term potential of QDII products.

That first round of products is mainly from Hong Kong and other Asia-Pacific stock markets.

"The new QDII products will be more widely distributed in places such as Europe," Zhao said.

Apart from geography, new QDII products should also span different types of markets, according to Ulrich.

"For example, while global stock markets are struggling, fund managers can transfer funds from stocks to commodities such as corn, soybean, crude oil, gold and other precious metals, which have a high level of appreciation and resilience," Ulrich said.

Some global banks are already investing in lower-risk industries. Bank of East Asia, Standard Chartered Bank, HSBC and Deutsche Bank all released new QDII products recently. Most will invest in bonds, agriculture and energy.

The exchange rate also affects QDII product yield and the appreciating yuan is increasing investor risk.

"QDII products can be designed to combine, for example, gold investment and foreign exchange. Investors could also use options and other derivatives to avoid exchange rate risk," Ulrich said.

(China Daily 03/19/2008 page15)