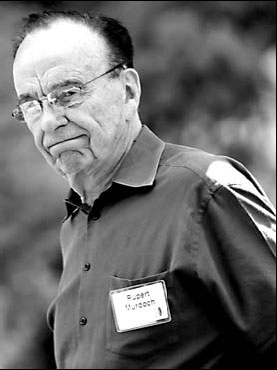

Media mogul gets more downcast

News Corp Chief Executive Rupert Murdoch said he has become "more pessimistic" in the past month about the US economy as an advertising slowdown in local television and newspaper markets whips across the media industry.

Murdoch's remarks are the strongest public acknowledgment of an imminent advertising recession among big media leaders and contrast with remarks made by companies such as Viacom Inc CEO Philippe Dauman, who said threats of a recession have yet to show any impact on finances so far.

In February, Walt Disney Co also said its businesses grew despite a turbulent economy and painted an optimistic view for the year.

Media mogul Murdoch, who controls the MySpace Internet social network, Dow Jones & Co, and Sky Italia, said revenue at his local TV stations are 5 percent behind expectations. At the recently acquired Dow Jones & Co, which publishes the flagship Wall Street Journal newspaper, he expected at least another down year.

"We may be in for a temporary downturn for a year or so," Murdoch said, referring to Dow Jones, at the annual Bear Stearns media conference in Florida.

However, he said News Corp, which also owns 20th Century Fox movies studio and Fox TV network, is well positioned to gird against an economic slowdown as its reliance on advertising has decreased to 23 percent from 41 percent. Bucking trends, Murdoch repeated a commitment to invest heavily in the Wall Street Journal and Dow Jones to make it the globe's preeminent news source as local newspapers, which are slashing costs and jobs to protect profits, look for sources for national and world news.

Agencies

(China Daily 03/12/2008 page17)